What's a 403(b) Plan?

Table of Contents

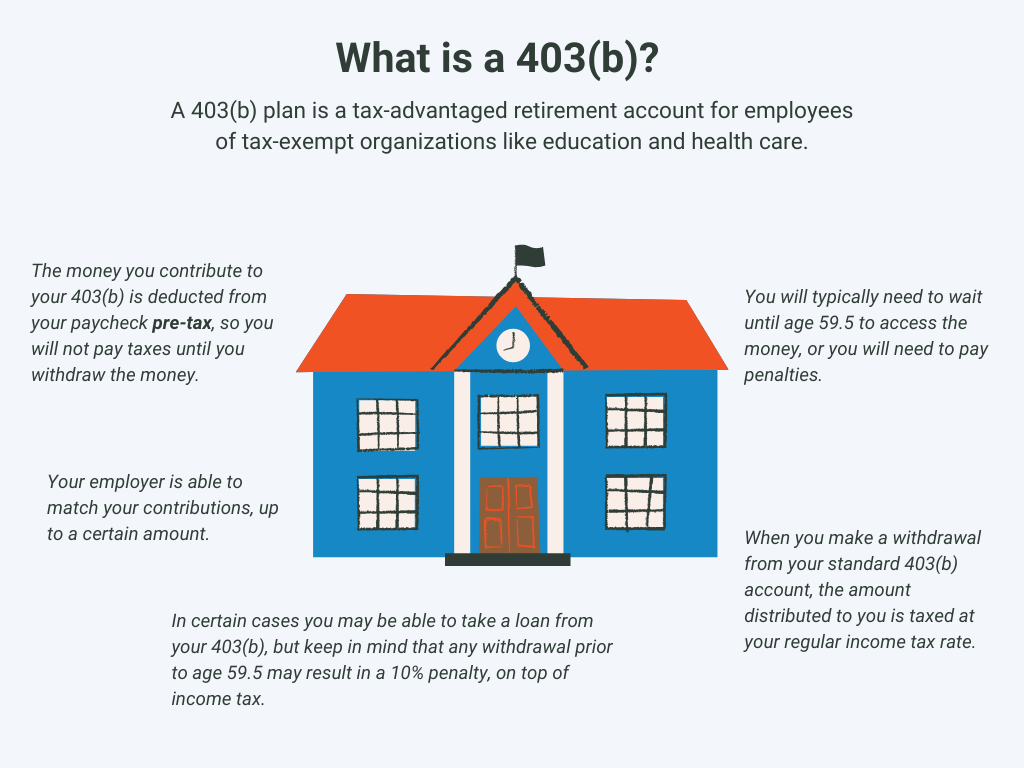

Planning for retirement is one of the most important financial steps you can take, and understanding your options is an important part of building a secure future. Among the many retirement savings vehicles available, a 403(b) plan is specifically designed for employees of public schools, non-profit organizations, and certain tax-exempt institutions. This tax-advantaged account allows eligible workers to save and invest for retirement while benefiting from tax-deferred growth or tax-free withdrawals, depending on the type of contributions made. Whether you’re an educator, healthcare worker, or non-profit employee, knowing how a 403(b) plan works can help you maximize your retirement savings.

Understanding the Basics of a 403(b) Plan

Is a 403(b) a Good Retirement Plan?

A 403(b) plan can be a strong retirement savings option. These plans offer significant tax advantages that can help individuals grow their retirement savings more efficiently over time.

One of the primary benefits of a 403(b) is the ability to make pre-tax contributions, which lowers your taxable income in the year you contribute. This means you pay less in taxes now while allowing your investments to grow tax-deferred until you withdraw funds in retirement. Additionally, many 403(b) plans now offer a Roth option, which allows after-tax contributions with the benefit of tax-free withdrawals in retirement, providing flexibility based on your financial situation.

Beyond tax advantages, many employers offer matching contributions, which essentially provide free money toward your retirement savings. If your employer offers a match, taking full advantage of it can significantly boost your long-term wealth. Another key advantage is compound growth, which allows your contributions and investment earnings to generate additional returns over time—making early and consistent investing particularly beneficial.

Who Benefits Most from a 403(b) Plan?

A 403(b) plan is particularly beneficial for:

- Teachers, school administrators, and public-school employees

- Healthcare workers employed by non-profit hospitals and clinics

- Employees of religious organizations and tax-exempt charities

- University faculty and staff working for non-profit institutions

What Is the Difference Between a 401(k) and a 403(b)?

While both 401(k) and 403(b) plans serve as employer-sponsored retirement accounts, key differences set them apart, primarily in terms of eligibility, investment options, and contribution rules.

Eligibility: Public vs. Private Sector Employees:

The main distinction between the two plans is who can participate. A 401(k) is typically offered by private-sector employers, including corporations and for-profit businesses, whereas a 403(b) is reserved for employees of public schools, non-profit organizations, and certain tax-exempt institutions.

Investment Options and Potential Limitations:

Another major difference lies in investment choices. While 401(k) plans usually offer a broad selection of mutual funds, index funds, and sometimes even individual stocks or bonds, 403(b) plans historically had more limited investment options, often focusing on annuities and mutual funds. However, many modern 403(b) plans now offer a wider variety of investment choices, bringing them closer to 401(k) offerings.

Additionally, 403(b) plans are not subject to the same oversight as 401(k) plans under ERISA (the Employee Retirement Income Security Act) unless the employer makes matching contributions. This means that, in some cases, administrative costs may be lower for 403(b) plans, but it can also mean fewer regulatory protections for participants.

Contribution Limits and Catch-Up Provisions:

Both plans have identical annual contribution limits, which are set by the IRS. For 2025, the maximum employee contribution for both 401(k) and 403(b) plans is $23,500, with an additional $7,500 catch-up contribution allowed for those aged 50 and older1.

However, 403(b) plans offer an extra advantage for long-term employees. If you have 15 or more years of service with the same 403(b)-eligible employer, you may qualify for an additional catch-up contribution of up to $3,000 per year, potentially increasing your total contribution limit beyond what a 401(k) allows2.

Which Plan Is Better?:

The best plan depends on your employer and your specific financial needs. If you work for a school, non-profit, or religious organization, a 403(b) is likely your primary option. However, if you have the choice between the two (such as in organizations that offer both), comparing investment options, fees, and employer match structures can help determine which plan aligns best with your retirement goals.

Managing Your 403(b) Plan

What Happens to a 403(b) When You Leave a Job?

If you leave your job, your 403(b) doesn’t disappear—but what you do with it can significantly impact your long-term retirement savings. You have several options:

- Rollover to Another Retirement Account – You can roll over your 403(b) into another tax-advantaged retirement account, such as a traditional IRA, Roth IRA, or a new employer’s 401(k) or 403(b) plan (if permitted). A direct rollover helps make sure you avoid immediate taxes and penalties while keeping your retirement funds growing.

- Leave It in the Existing Plan – Some employers allow former employees to keep their 403(b) accounts open, though you won’t be able to contribute further. If the plan has low fees and strong investment options, this may be a good choice.

- Cash It Out (With Penalties) – Withdrawing funds before age 59½ usually results in income taxes plus a 10% early withdrawal penalty3. There are some exceptions, such as disability or certain hardships, but in most cases, cashing out significantly reduces your retirement savings.

- Convert to a Roth IRA – If you expect your tax rate to rise in the future, converting to a Roth IRA may be beneficial. However, you’ll owe taxes on the rollover amount in the year of conversion, so careful tax planning is essential.

To help ensure continued growth after leaving a job, the best strategy is to roll over your 403(b) into an account that aligns with your retirement goals while maintaining tax advantages. Avoiding unnecessary withdrawals will keep your savings compounding over time.

What Are the Disadvantages of a 403(b)?

While a 403(b) plan offers valuable tax advantages, it does have some potential downsides to consider:

- Limited Investment Options – Compared to 401(k) plans, some 403(b) accounts have fewer investment choices. This may limit diversification and growth potential, though newer plans are expanding their investment offerings.

- Penalties for Early Withdrawal – Like most retirement accounts, a 403(b) comes with a 10% early withdrawal penalty if you take money out before age 59½, in addition to paying regular income taxes. Exceptions apply for certain hardships, but accessing funds early can be costly.

- Employer-Dependent Contributions – Unlike many 401(k) plans, employer matching contributions in 403(b) plans are not guaranteed. Some organizations offer generous matches, while others provide none at all. If your employer doesn’t contribute, your retirement savings will rely entirely on your own contributions.

- Potentially Higher Fees – Some 403(b) plans, particularly those that rely heavily on annuities, may have higher administrative fees or surrender charges compared to other retirement accounts. These costs can eat into your investment returns over time.

Despite these drawbacks, a 403(b) can still be a powerful retirement savings tool, especially if you take full advantage of tax benefits, employer contributions (if available), and long-term investment growth.

Roth vs. Traditional 403(b): Which One is Right for You?

Choosing between a Roth 403(b) and a Traditional 403(b) comes down to tax treatment and your long-term financial strategy.

Key Differences in Tax Treatment

Feature | Traditional 403(b) | Roth 403(b) |

Contributions | Pre-tax (reduces taxable income today) | After-tax (no immediate tax benefit) |

Growth | Tax-deferred (taxes owed at withdrawal) | Tax-free (no taxes owed on qualified withdrawals) |

Withdrawals in Retirement | Taxed as ordinary income | Tax-free if the account has been held for at least 5 years and you’re over 59½ |

Required Minimum Distributions (RMDs) | Yes, starting at age 73 | Yes (unless rolled into a Roth IRA) |

How to Choose the Right One for You

- Choose a Traditional 403(b) if:

- You want to lower your taxable income now.

- You expect to be in a lower tax bracket in retirement.

- You prefer tax-deferred growth and don’t mind paying taxes on withdrawals later.

- Choose a Roth 403(b) if:

- You expect your tax rate to be higher in retirement.

- You want tax-free withdrawals and more flexibility later in life.

- You have other pre-tax retirement savings and want to diversify your tax exposure.

If you’re unsure, contributing to both a Traditional and a Roth 403(b)—if your plan allows—can provide tax diversification and flexibility when withdrawing funds in retirement. Understanding what is a qualified retirement plan can also help ensure you choose the right option for your financial future.

Common Mistakes to Avoid with a 403(b) Plan

Not Taking Full Advantage of Employer Matching

If your employer offers a match, contribute at least enough to get the full benefit. Failing to do so is essentially turning down free money that could significantly grow your retirement savings over time. One key advantage of investing early for retirement is maximizing compound interest and employer contributions.

Ignoring Fees and Investment Costs

Some 403(b) plans have higher administrative or investment fees, especially those offering annuities. Over time, excessive fees can erode your returns. Reviewing your plan’s expense ratios and considering lower-cost investment options can help keep more of your money working for you. Keeping an eye on expenses is one of the tips for financial success that can make a big difference in your long-term savings.

Withdrawing Funds Too Early

Tapping into your 403(b) before retirement can trigger taxes and penalties, significantly reducing your savings. If you’re facing financial hardship, explore other options—such as loans or hardship withdrawals—before making a permanent dent in your retirement funds. Additionally, understanding what are required minimum distributions will help you plan withdrawals strategically to avoid penalties and optimize your savings.

Conclusion: Start Planning Your Retirement with Insight Wealth Strategies

Navigating the complexities of a 403(b) plan and other retirement accounts can be challenging, but you don’t have to do it alone. At Insight Wealth Strategies, our team of experienced financial advisors is here to help you make informed decisions about your retirement savings. Whether you’re determining the best contribution strategy, evaluating rollover options, or deciding between a Traditional or Roth 403(b), we can provide the personalized guidance you need to secure your financial future.

We specialize in comprehensive financial planning tailored to your specific goals, ensuring that your 403(b) and other investments align with your long-term retirement strategy. If you’re looking for expert financial planning in your area, visit our locations:

📍 Financial Planning in Houston

📍 San Ramon Financial Planning

Planning for retirement is one of the most important financial steps you can take—let Insight Wealth Strategies help you make the most of your 403(b) and beyond. Schedule a consultation today to start building a stronger financial future.

Reviewed by,

Brian Stormont, CFP®

Brian Stormont is a comprehensive, fee-only financial advisor with Insight Wealth Strategies who began his career in the financial industry in 2000. His expertise encompasses retirement planning, investment planning, estate planning, and high-level strategies to help business owners and individuals minimize their income taxes.

Sources:

- https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000

- https://www.irs.gov/retirement-plans/403b-plan-fix-it-guide-an-employee-making-a-15-years-of-service-catch-up-contribution-doesnt-have-the-required-15-years-of-full-time-service-with-the-same-employer

- https://www.irs.gov/retirement-plans/hardships-early-withdrawals-and-loans

Insight Wealth Strategies, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Insight Wealth Strategies, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Insight Wealth Strategies, LLC unless a client service agreement is in place.

Insight Wealth Strategies, LLC (IWS) and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.