San Ramon Retirement Planning

Retirement Planning San Ramon Can Depend On

It’s never too early to start retirement planning. San Ramon locals know that Insight Wealth Strategies is the best source for expert financial advice. Read on to learn about how our customized retirement planning services can help transform your financial future for the better.

A Personalized Retirement Plan, For You

If you’re searching for a San Ramon retirement planner, look no further—Insight’s fiduciaries are ready to help you turn your financial goals into a reality. We’re a fee-only firm, staffed with qualified financial professionals whose interests align with yours. When you partner with an Insight Wealth Strategies advisor, you gain financial dexterity and peace of mind, too.

Gain valuable insight into your existing accounts, address issues, and streamline your financial journey with strategic expertise. It all starts with a free consultation for our retirement planning services. We’ll take time to get to know you and understand your retirement goals from a personal perspective. From there, your compatible, qualified financial advisor will take a deep dive into all the requisite data behind your customized retirement plan.

With a combination of comprehensive information gathering, comparative research, state-of-the-art financial modeling, and strategic thinking, your Insight advisor will lay out a clear, actionable plan to help you work toward a successful retirement.

Eliminate uncertainties about the state of your personal financial planning. Our team will answer any questions you may have, from clarifying employer benefit programs to strategizing alternative revenue streams and investments. Our personalized, client-led approach to fiduciary advising makes us one of the top retirement planning companies San Ramon’s citizens rely on.

Whether you’re decades away from retirement or are eagerly reworking your finances to retire sooner, everyone can benefit from solid retirement planning advice. San Ramon-based fiduciaries from Insight Wealth Strategies are the best individuals to help you do that. We make it our policy to keep our clients informed, educated, and empowered throughout the financial planning process.

Start Planning in a Few Clicks

Gain a holistic view of your financial situation, bring concrete goals into focus, and create a solid foundation for the future. For San Ramon retirement planning that looks toward the future, look no further.

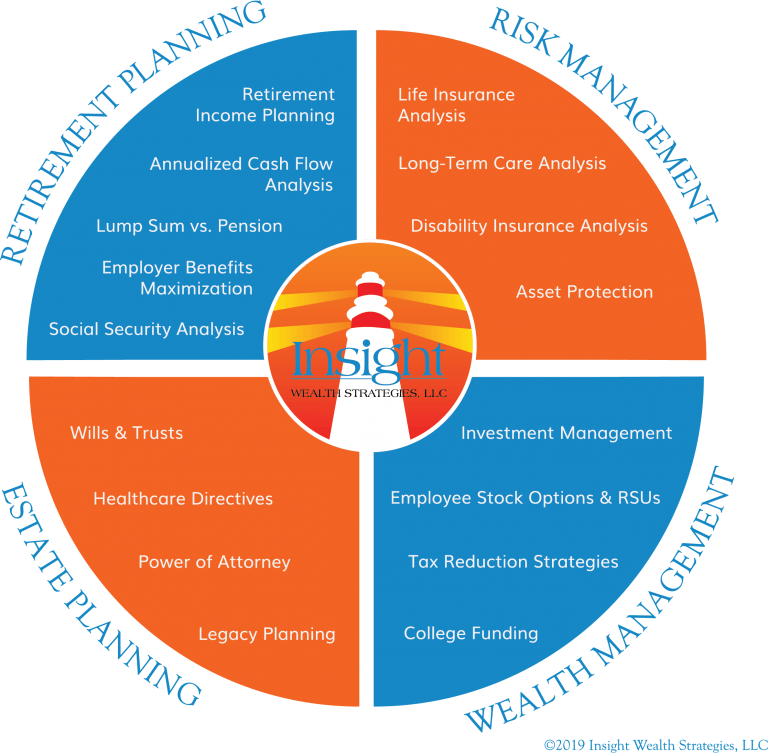

Our Service Offering

- Retirement planning – Prepare for the future, and gain confidence and peace in the present

- Financial planning – Access expert financial strategies, completely personalized to you

- Investment management – Take your portfolio to the next level with recommended assets

Whether you’re looking for San Ramon financial management, San Ramon investment management, or retirement planning – we’re proud to offer robust financial services to the entire San Ramon area. San Ramon wealth management from Insight Wealth Strategies helps transform our clients’ finances for the better.

Frequently Asked Questions:

There’s no surefire way of fortifying your retirement finances. However, working with a professional fiduciary is the best place to start.

While it’s possible to self-educate, investigate your own situation, and draw up a retirement planning strategy, most individuals find the effort to be time-consuming, stressful, and oftentimes, not all that fruitful. Your schedule is full of activity, and your time should be dedicated to your career, your family, your hobbies, and every other aspect of your day-to-day life. That’s why we provide retirement planning San Ramon can rely on.

A fiduciary advisor acts in your best interest, providing unbiased advice, comprehensive personal financial planning, and transparent fee structures. Your advisor ensures that your retirement strategy is tailored to your unique needs and financial goals.

Not only can you consult with a fiduciary, but you should. One-size-fits-all retirement plans from employers and financial institutions probably aren’t serving your unique needs as well as they could. A personal retirement advisor will be able to pick out potential problems and opportunities for growth that previously went unnoticed.

Review and update your retirement plan annually or when significant life events occur, such as marriage, divorce, the birth of a child, or significant changes in income or health, to ensure it remains aligned with your goals. Consulting with a certified financial planner can ensure you are on the right path for your retirement plans.