Investment Management Houston

Fee-Only Investment Management for Houston

Work toward your investment goals without lifting a finger—Insight’s fee-only financial advisors are ready to put their expertise to work. Whether you’re an aspiring investor entering the investment landscape for the very first time or seeking solutions to better manage your extensive portfolio, our team will dedicate themselves to your financial life vision and deliver investment advice and strategies catered to your unique needs.

Expert Wealth Managers,

Balanced Investment Portfolios

When it comes to investment management, Houston residents rely on Insight Wealth Strategies. The “why” is simple—trustworthy investment firms (Houston-based or otherwise) should be fee-only, transparent, and staffed with decorated, client-friendly advisors. Insight checks all the boxes for elevating your wealth management (and then some).

Insight’s fiduciaries follow a system of qualitative analysis, risk management and strategic portfolio management. We combine thorough research with powerful modeling software and years of industry experience to create adaptive portfolios and identify investment opportunities that help our clients’ work towards their financial goals.

Insight operates as a fee-only management firm, which means that your financial advisor’s interests will align naturally with your own. Set aside worries about ill-intentioned middlemen or product pushers and bolster your investment strategy with guidance from our team of financial professionals. Our client-advisor partnerships are a great method of working towards building your wealth and financial future without breaking a sweat—even in the Houston heat. We’ll take the time to get to know you before matching you with a compatible investment advisor who can provide tailored investment solutions to align with your financial objectives.

Here are just a few features of our comprehensive Houston investment management program:

- A customized ranking of your existing assets based on a risk-adjusted return

- Optimized asset allocation that accounts for tax planning efficiency, portfolio expenses, and potential growth

- Continuous monitoring of market trends, economic conditions, and portfolio performance, and timely adjustment of assets as needed

We understand that you have your pick of investment companies. Houston is home to plenty of wealth management services, but we’re confident that working with Insight Wealth Strategies is the best possible choice. There’s no reason to delay, so get in touch with our team today.

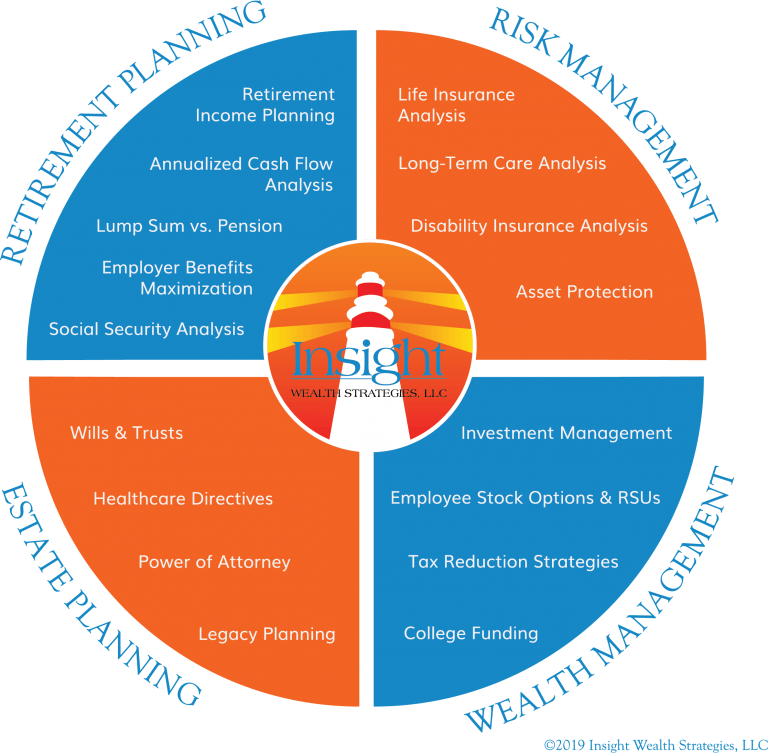

Our Service Offering

- Investment management – Diversity your portfolio with the very best assets

- Retirement planning – Prepare to enjoy the fruits of your labor for years to come

- Financial planning – Meet life’s many surprises with confidence and security

Whether you’re looking for a Houston financial advisor, Houston retirement planning, or investment management, our financial advice is at your fingertips.

Start Investing Smarter

Frequently Asked Questions

Investment management is a financial management service to aid investors, that tracks and optimizes the buying and selling of investment assets. This meticulous asset management process is designed to deliver maximum growth and profit potential to the client. These assets can include stocks, bonds, mutual funds, ETFs, real estate and more.

The most common fee structures for investment management services are:

- Fixed fee: a set payment amount that doesn’t take the individual account details into consideration.

- Hourly fee: a payment based on the billed hours of the individual financial advisor.

- Asset-based fee: a percentage-based fee derived from the total monetary value of the investment portfolio.

- Performance-based fee: a percentage-based fee that is calculated post-growth, the size of which depends upon the performance of the portfolio.

- Commission fee: a fee that is derived from commissions of sales and purchases of portfolio assets.

Insight Wealth utilizes an asset-based fee-only structure, meaning we have a natural incentive to bolster your portfolio rather than push individual products or transactions like other financial advisors.

Investment management firms generally charge a fee for the assets under the firm’s management. This fee is usually a percentage of the total value of the portfolio under management. Many firms charge a management fee of around 1 percent, and offer a sliding fee scale depending on the amount of assets held.

Working with a wealth advisor from Insight Wealth Strategies offers numerous advantages. Our advisors are deeply committed to understanding your personal and financial circumstances to develop a tailored financial strategy. With our expertise in financial services, we ensure that your wealth planning is comprehensive, addressing not only investment management but also retirement planning, tax considerations, and estate planning. This holistic approach helps secure your financial future.