Texas Capital Gains Tax: What You Need to Know

Table of Contents

Many Texans assume they are completely exempt from capital gains tax, but while Texas does not impose a state capital gains tax, federal capital gains taxes still apply. Whether you’re selling real estate, stocks, or a business, it is helpful to understand how capital gains are taxed in order to make strategic financial decisions. The tax rate you pay can vary based on factors like your income, the type of asset sold, and how long you’ve held it. This guide will explain how capital gains taxes work in Texas, outline available exemptions, and provide strategies to help you minimize your tax burden.

Does Texas Have a Capital Gains Tax?

One of the reasons Texas is considered a tax-friendly state is its lack of a state income tax, which also means no additional state taxation on capital gains. While this can be beneficial for investors and business owners, federal capital gains tax rules remain the same, regardless of which state you live in. Understanding these rules is an important part of managing your tax liability effectively.

How Federal Capital Gains Tax Applies to Texans

Even though Texas does not have a state capital gains tax, residents must still pay federal capital gains taxes when selling assets. The amount you owe depends on how long you’ve held the asset before selling it. The IRS classifies capital gains into two categories: short-term and long-term, each with different tax rates.

Short-Term vs. Long-Term Capital Gains

- Short-term capital gains apply to assets held for less than one year and are taxed as ordinary income. This means your tax rate could range from 10% to 37%, depending on your federal income tax bracket1.

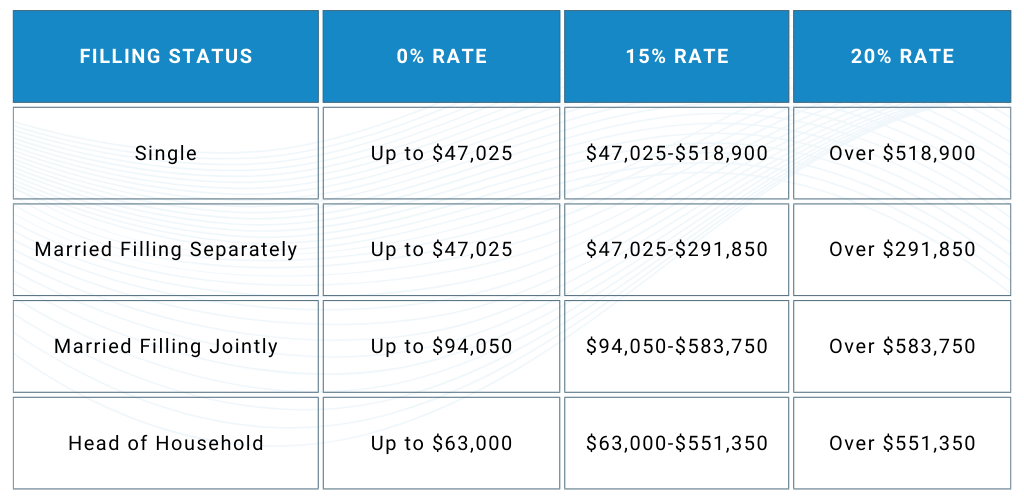

- Long-term capital gains apply to assets held for more than one year and are taxed at preferential rates of 0%, 15%, or 20%, depending on your taxable income1.

Holding investments for more than a year can significantly reduce your tax burden, as long-term capital gains are taxed at lower rates than short-term gains.

Additional Federal Taxes That May Apply

In addition to standard capital gains taxes, some Texans may be subject to additional federal taxes when selling investments, real estate, or other assets. Two key taxes to be aware of are the Net Investment Income Tax (NIIT) and Depreciation Recapture.

- Net Investment Income Tax (NIIT): If your modified adjusted gross income (MAGI) exceeds $200,000 for single filers or $250,000 for married couples filing jointly, you may owe an additional 3.8% tax on net investment income2. This includes capital gains from stocks, real estate (not your primary residence), and other investment assets.

- Depreciation Recapture: If you sell a rental property or other depreciated assets, you may owe taxes on the depreciation deductions you claimed during ownership. The IRS taxes recaptured depreciation at a maximum rate of 25%, which can increase your overall tax liability when selling investment properties3.

Being aware of these additional taxes can help you plan more effectively and avoid unexpected tax bills when selling assets.

Capital Gains Tax Exemptions & Deductions

While federal capital gains taxes apply to Texans, several exemptions and strategies can help reduce or defer tax liability. Whether you’re selling a home, real estate investment, or business stock, understanding these provisions can help you maximize your after-tax returns.

Primary Residence Exclusion (For Home Sellers)

If you’re selling your primary residence, you may be eligible to exclude up to $250,000 (single filers) or $500,000 (married filing jointly) in capital gains, provided you meet the following IRS criteria4:

- You must have owned and lived in the home as your primary residence for at least two of the last five years before the sale.

- You cannot have used this exclusion on another home sale within the past two years.

1031 Exchange for Real Estate Investors

Real estate investors can defer capital gains taxes using a 1031 exchange, which allows them to reinvest proceeds from a property sale into another like-kind property without immediate tax consequences. However, the IRS imposes strict rules:

- A replacement property must be identified within 45 days of selling the original property.

- The transaction must be completed within 180 days to qualify for deferral.

By rolling over gains into a new investment property, real estate investors can continue building wealth while delaying capital gains tax payments.

Qualified Small Business Stock (QSBS) Exemption

Entrepreneurs and investors in Qualified Small Business Stock (QSBS) under Section 1202 of the tax code may be able to exclude up to 100% of capital gains from federal taxation. To qualify:

- The stock must be from a C corporation engaged in an active business.

- The stock must have been held for at least five years before selling.

- The corporation must meet certain gross asset and business activity requirements at the time of issuance.

This exemption can be particularly beneficial for investors and founders of startups, offering significant tax savings when exiting a business.

Strategies to Reduce Capital Gains Tax in Texas

Although Texans must pay federal capital gains taxes, several strategies can help minimize their tax burden. By planning strategically, investors, homeowners, and business owners can keep more of their profits while staying compliant with tax laws.

1. Hold Investments for Over a Year

One of the simplest ways to reduce capital gains taxes is to hold investments for more than one year before selling.

- Short-term capital gains (assets sold within a year) are taxed at ordinary income rates, which can be as high as 37%1.

- Long-term capital gains (assets held for over a year) are taxed at preferential rates of 0%, 15%, or 20%, depending on income1.

By waiting just a few extra months before selling, you could significantly lower the tax rate applied to your gains.

2. Offset Gains with Losses (Tax-Loss Harvesting)

Tax-loss harvesting is a strategy where investors sell underperforming assets at a loss to offset capital gains, thereby reducing taxable income.

- If total capital losses exceed capital gains, you can deduct up to $3,000 per year against ordinary income.

- Any unused losses can be carried forward indefinitely to offset gains in future years.

This method is particularly useful for investors looking to rebalance their portfolios while minimizing taxes.

3. Use Retirement Accounts to Shelter Gains

Investing through tax-advantaged accounts can help defer or even eliminate capital gains taxes:

- Traditional IRAs & 401(k)s: Gains within these accounts grow tax-deferred, meaning you won’t pay capital gains tax until you withdraw funds in retirement.

- Roth IRAs: Qualified withdrawals are completely tax-free, making them an excellent long-term investment vehicle.

- Health Savings Accounts (HSAs): Investment gains in an HSA grow tax-free, and qualified medical withdrawals are also tax-free.

Maximizing contributions to these accounts can help shield investments from immediate taxation.

4. Consider Gifting or Inheritance Strategies

Capital gains tax can sometimes be minimized or avoided through strategic gifting and estate planning:

- Gifting appreciated assets: Transferring assets to family members in lower tax brackets can reduce the overall tax burden when they sell the asset.

- Stepped-up cost basis: When heirs inherit assets, they receive a new cost basis equal to the fair market value at the time of inheritance, which can eliminate taxable capital gains on long-held investments.

These strategies can be particularly useful for estate planning and passing wealth to future generations efficiently.

Final Thoughts

While Texas does not impose a state capital gains tax, Texans must still navigate federal tax laws when selling assets such as real estate, stocks, and businesses. Understanding the differences between short-term and long-term capital gains, as well as additional taxes like the Net Investment Income Tax (NIIT) and depreciation recapture, is essential for effective tax planning.

By leveraging exemptions, tax-efficient investment strategies, and retirement accounts, you can significantly reduce your tax liability and maximize your after-tax returns. Whether you’re an investor, business owner, or homeowner, careful planning can make a substantial difference in your long-term financial success.

At Insight Wealth Strategies, we specialize in helping Texans develop personalized tax-saving strategies to protect their wealth. If you’re in the area, connect with our Houston office or explore our approach to investment management in Houston to see how we can help. Schedule a consultation today to optimize your investments and minimize unnecessary taxes.

Reviewed by,

Chad Seegers, CRPC®

Chad began his career with Sagemark Consulting in 2005 and then became a Select member of Sagemark’s Private Wealth Services which operated as a national resource for financial planners focusing on Advanced Strategies in the High Net Worth marketplace. Chad then began his partnership with Insight Wealth Strategies in 2013 focused on retirement planning primarily with Oil and Gas employees and executives. His primary areas of expertise are retirement, estate, and investment strategies as he serves as Investment Strategist for the financial planning team.

More Resources for Tax Strategies

Sources:

- https://www.irs.gov/taxtopics/tc409

- https://www.schwab.com/taxes/net-investment-income-taxes

- https://www.schwab.com/learn/story/understanding-depreciation-recapture-on-rentals

- https://www.irs.gov/taxtopics/tc701

Insight Wealth Strategies, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Insight Wealth Strategies, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Insight Wealth Strategies, LLC unless a client service agreement is in place.

Insight Wealth Strategies, LLC (IWS) and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.