Smart Financial Planning Moves to Make

If You’re Worried About the Economy

Table of Contents

Economic uncertainty—whether due to market volatility, inflation, or the possibility of a recession—can shake even the most seasoned investors. But the best time to plan is before an economic crisis hits. Thoughtful financial planning can help you stay grounded, protect your wealth, and remain focused on long-term goals.

In this article, we’ll walk through actionable strategies to help you prepare your finances for a downturn and boost your confidence in the face of economic headwinds. This involves understanding the importance of savings and recognizing the role of investment in growing your wealth.

Build a Strong Financial Foundation

Prioritize Emergency Savings

Even with significant assets, maintaining a liquid emergency fund is important. Aim to reserve three to six months of core living expenses to preserve your lifestyle and safeguard investments during market turbulence.

Here’s an example for a high-income household:

- Housing (mortgage, taxes, utilities): $6,000

- Groceries and home essentials: $1,500

- Transportation: $1,200

- Insurance (health, life, property): $1,500

- Debt obligations and other essentials: $3,000

- Total monthly expenses: $13,200

- Six-month emergency fund goal: $79,200

Keep these funds in a high-yield savings or money market account, where they remain accessible and protected.

Revisit Your Monthly Budget

A high income doesn’t mean budgeting isn’t necessary. In uncertain times, strategic adjustments can free up capital and preserve liquidity. It’s crucial to prepare for economic uncertainty by closely monitoring your budget and finding ways to limit unnecessary expenses. Consider reducing recent spending and redirecting excess from luxury categories and services—like travel or subscriptions—toward savings or debt reduction.

Here’s a sample “lean” yet comfortable allocation:

- Essentials (60–65%) – Housing, tuition, healthcare, insurance

- Savings & Investments (25–30%) – Retirement accounts, brokerage, emergency fund

- Discretionary (10–15%) – Travel, dining, entertainment

Focusing on these categories can help you adapt to a constantly changing economy and maximize your financial gains by strategically directing funds. These small recalibrations help build resilience in future years without sacrificing your financial lifestyle.

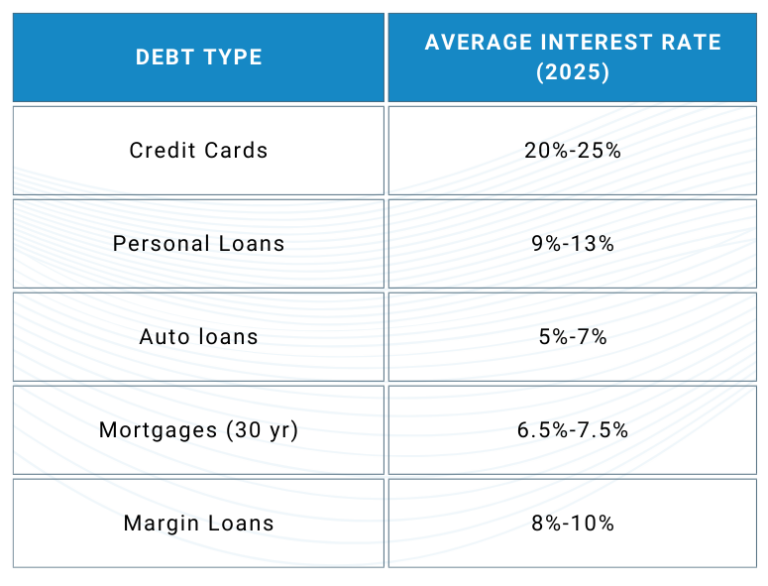

Manage and Minimize Debt Wisely During Economic Downturns

Focus on High-Interest Debt First

Unsecured consumer debt—especially credit cards—can be especially damaging during downturns. Even modest balances can erode cash flow and increase risk exposure.

Prioritize paying off anything over 10% interest, especially revolving debt. Reducing liabilities strengthens your cash flow and gives you greater agility in tough markets.

Explore Refinancing or Consolidation

Refinancing or consolidating loans can be an efficient way to lower your interest burden:

- Mortgages: Look into buying at a lower or fixed rate.

- Business or personal loans: Renegotiate terms if your credit profile has improved.

- Consolidation: Useful for simplifying payments, an option banks might offer—but only if it improves terms.

Refinancing shouldn’t be used just to delay payments. Focus on improving long-term cost efficiency and the flexibility of your finances.

Stay Invested—But Reassess Your Portfolio for Economic Resilience

Avoid Emotional Decision-Making

Market downturns can be unnerving. Emotional investing is one of the biggest threats to wealth building and preservation. Market downturns often lead to fear-based decisions—but history rewards those who stay invested.

- The S&P 500 fell over 38% in 2008—a time of significant economic recession- then recovered and more than tripled over the next decade.

- In 2020, markets plummeted during COVID-19, illustrating the impact of global recession—only to rebound within months.

Selling during a recession often means locking in losses and missing out of the recovery phases of the market.

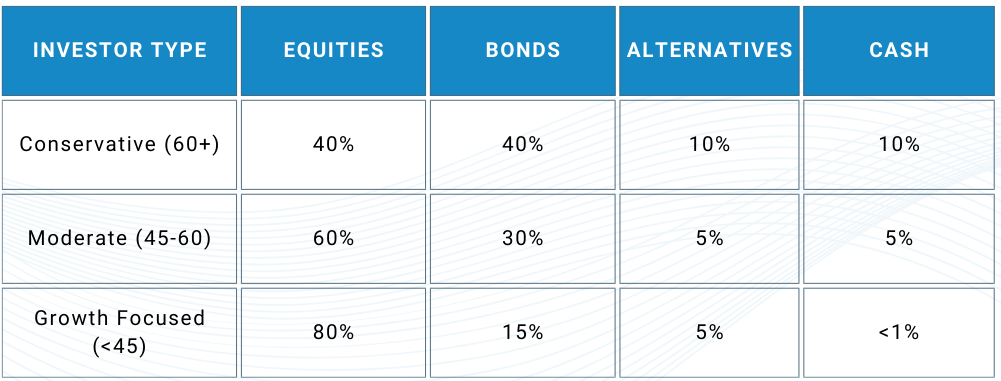

Rebalance for Risk Tolerance

Economic shifts are a good time to review your allocation. Is your portfolio still aligned with your goals, time horizon, and comfort level?

- Nearing retirement or experiencing an economic downturn? Shift toward income-generating and lower-volatility investments.

- Still in growth mode? Ensure you’re not overly conservative in inflationary periods.

Rebalancing helps control risk and maintain consistency with your financial strategy. Financial advisors can offer valuable advice to assess necessary adjustments during drastic economic changes.

Diversify to Reduce Volatility

Diversification smooths returns and reduces risk. A well-structured portfolio includes:

- Asset types: Stocks, bonds, alternatives, cash

- Sectors: Tech, energy, healthcare, consumer goods

- Geographies: U.S., international, emerging markets

- Styles: Growth, value, large- and small-cap

Sample allocation by investor type:

Diversification doesn’t mean over-complication—it means strategic balance.

Strengthen Your Earning Potential

Upskill or Reskill in Your Field

Economic downturns in the job market can impact professionals at all levels. Many companies value professionals who continue learning and adapting, especially during times of economic uncertainty. Staying competitive means investing in your skills and staying adaptable.

Investing in certifications or advanced skills can improve your work opportunities and income resilience. These skills include:

- Data and analytics (Excel, SQL, Power BI)

- Cloud and cybersecurity (AWS, Google Cloud, Security+)

- Project management (PMP, Agile/Scrum)

- Financial certifications (CFA, CPA, CFP®)

Platforms for flexible learning:

Continual learning helps protect your income stream and creates new opportunities, essential for economic resilience. Expanding your skills can be a wise investment during tough economic times.

Build Multiple Income Streams to Weather Economic Challenges

High-income individuals can benefit from strategic income diversification, such as:

- Consulting or freelance engagements

- Real estate investments

- Dividend-producing portfolios

- Online ventures or private equity

- Serving on boards or advisory panels

Additional income sources enhance both stability and optionality.

Protect Yourself with Insurance and Legal Documents

Review Health and Disability Coverage

Illness or job loss can disrupt even the best-laid plans. Explore insurance products that offer both flexibility and sufficient coverage, particularly during economic uncertainty. Ensure you have adequate coverage:

- Health insurance: Does it cover major medical and dependents’ needs?

- Disability insurance: Replace income in the event of extended illness or injury.

- COBRA or private options: Plan ahead for possible job loss if economic changes are a possibility.

Don’t overlook long-term disability, especially if you’re self-employed or your family relies on your income.

Update Wills and Financial Powers of Attorney

In unpredictable times, estate planning becomes even more critical. Every financially established household should understand the differences between wills and trusts and have:

- A will outlining asset distribution and guardianship

- A financial power of attorney in case of incapacity

- A medical directive or healthcare proxy for health decisions

Review these documents regularly—especially after major life events. They provide clarity and peace of mind when it’s most needed.

Monitor Economic Trends Without Panic

Stay Informed from Reputable Sources

It’s wise to stay informed—but not all information is equal. Focus on data-driven insights, not speculation.

Trusted sources include:

- The Wall Street Journal

- Bloomberg

- The Economist

- Federal Reserve and BEA websites

- Morningstar or investment research platforms

Avoid reacting to headlines or social media noise. Filtering information protects your mindset—and your strategy. This strategy will help shield your finances from economic turbulence.

Set Scheduled Financial Check-Ins

Rather than reacting to daily market swings, schedule quarterly financial reviews. Focus on:

- Spending and savings

- Emergency fund status

- Debt and credit

- Portfolio allocation and performance

- Progress toward long-term goals

Prepare Now, Thrive Later

Economic volatility is inevitable—but how you respond is within your control. Building an adaptable, well-structured financial plan can provide clarity, reduce stress, and help position you for long-term success.

From budgeting and rebalancing to exploring new retirement income strategies and updating legal documents, the steps you take today will shape your economic future.

At Insight Wealth Strategies, we help clients create financial plans that adapt through every market cycle. If you’re feeling uncertain, now is the time to take action—not out of fear, but out of confidence in your ability to plan wisely.

Let’s plan together for a financially savvy future.

Reviewed by,

Brian Stormont, CFP®

Brian Stormont is a comprehensive, fee-only financial advisor with Insight Wealth Strategies who began his career in the financial industry in 2000. His expertise encompasses retirement planning, investment planning, estate planning, and high-level strategies to help business owners and individuals minimize their income taxes.

More Financial Planning Resources

Insight Wealth Strategies, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Insight Wealth Strategies, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Insight Wealth Strategies, LLC unless a client service agreement is in place.

Insight Wealth Strategies, LLC (IWS) and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.