The IRS has posted updated Min Present Value Segment Rates for the month of July 2025. They are as follows:

First Segment

4.38

Second Segment

5.41

Third Segment

6.13

First Segment

Decrease of 0.050

Second Segment

Decrease of 0.050

Third Segment

Flat

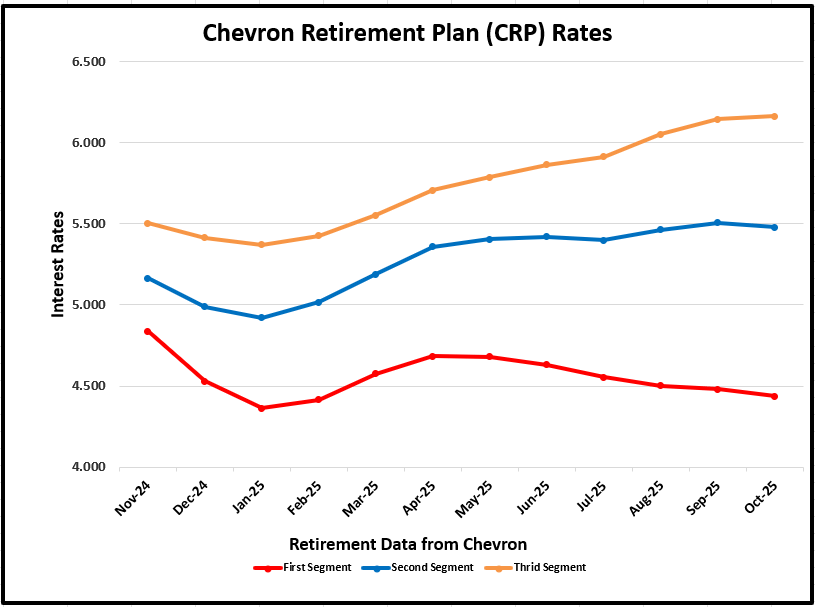

Based on the 3-month average that the CRP uses (April, May, June) the Segment Rates for October 2025 retirement are:

First Segment

4.437

Second Segment

5.480

Third Segment

6.163

First Segment

Decrease of 0.043

Second Segment

Decrease of 0.027

Third Segment

Increase of 0.020

The newly published IRS rates will be factored into the 3-month average used for the CRP lump sum calculation for Chevron employees who wish to take the CRP lump sum in October 2025.

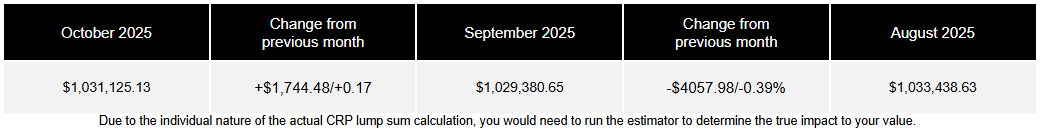

The following table demonstrates the hypothetical* impact of recent IRS segment rate updates to the lump sum value for a 65-year-old Chevron employee with an estimated single-life annuity payment of $7,500 month:

If a Chevron employee is debating September 2025 or October 2025 as their benefit commencement date, based solely on the lump sum value of the CRP, October would be the better of the 2 months. The approximate increase in the CRP value for a October retirement in this hypothetical scenario would be about +0.17%

While your CRP Lump Sum or your pension is not only based on interest rates, looking at recent rates over time can give you an idea of how your lump sum will be affected, and help you when you are choosing the best retirement date. Remember that interest rates have an inverse relationship with a lump sum pension, so as interest rates increase, lump sum pension value decreases.

*Due to the individual nature of the actual CRP lump sum calculation, you would need to run the estimator to determine the true impact to your value.

Note: Guidance for Standard Deduction, Earned Income Credit, and Reduced Refunds can be found on the IRS website.

With interest rates on the rise, many Chevron employees are asking themselves “Am I working for free?”.

If retirement is on the horizon for you, choosing the right month to commence benefits could be trickier than it seems.

We break down how segment rates work, how they affect your lump-sum payment and why the timing of your retirement is so important.

Our Chevron financial planners have over 20 years of experience helping Chevron employees navigate their retirement and get the most out of their benefits package.

The IRS determines minimum present value segment rates based on corporate bond yields. These rates are published monthly and help define the discount rates used to calculate pension liabilities and lump-sum payouts.

Interest rates can be categorized into:

If you would like to speak with a Financial Advisor in San Ramon, CA or Houston, TX about how segment rates can affect your unique situation, please fill out the form below and a team member will be in touch shortly.

IWS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to this web site or incorporated herein, and takes no responsibility therefore. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.