Setting Financial Goals for the New Year

The start of a new year brings a sense of renewal and an opportunity to focus on what matters most, including your finances. It’s the perfect time to evaluate your current financial situation, reflect on what worked and what didn’t, and set actionable goals for a more secure future. Whether you’re aiming to grow your savings, eliminate debt, or invest strategically for retirement, having a clear, well-defined plan is essential to turning your aspirations into reality. Let this year be the one where you take charge of your finances and set yourself on a path toward long-term success.

What Are Some Examples of Financial Goals?

Setting financial goals is about creating a roadmap that aligns with your priorities and aspirations. These goals can be categorized into short-term, mid-term, and long-term objectives, each serving a unique purpose in building your financial stability and future.

Short-Term Financial Goals

- Creating and Sticking to a Budget: Start by tracking your income and expenses to identify areas where you can cut back spending and allocate funds more effectively.

- Building an Emergency Fund: Aim to save 3-6 months of living expenses to prepare for unexpected situations, such as medical emergencies or job loss.

- Reducing High-Interest Debt: Focus on paying down credit card balances or other high-interest loans to free up cash flow and reduce financial stress.

Mid-Term Financial Goals

- Saving for a Home Down Payment: If homeownership is in your future, setting aside money for a down payment can improve loan options and lower mortgage costs.

- Investing for Larger Expenses: Mid-term investments (like bonds or diversified mutual funds) can help grow your money for goals like buying a car, starting a business, or paying for a wedding.

- Funding College Tuition or Education Costs: Whether it’s for yourself, a spouse, or children, setting up an education fund (e.g., 529 plans or education savings accounts) can ease the financial burden of tuition.

- Paying Off Student Loans or Other Large Debts: Tackling student loans, car loans, or medical debts can improve financial flexibility and reduce long-term interest costs.

- Boosting Retirement Contributions: As you progress in your career, increasing your 401(k) or IRA contributions can set you up for greater long-term security.

Long-Term Financial Goals

- Saving for Retirement: Contribute to retirement savings accounts like 401(k)s, IRAs, or other investment options to ensure a comfortable and secure future.

- Planning for Major Expenses: Strategize for significant financial milestones, such as funding college tuition, buying a home, or starting a business.

- Preparing for Long-Term Care or Estate Planning: Allocate resources to safeguard your future health care needs and create a plan to manage and distribute your assets effectively, and set routines early for year-end tax planning.

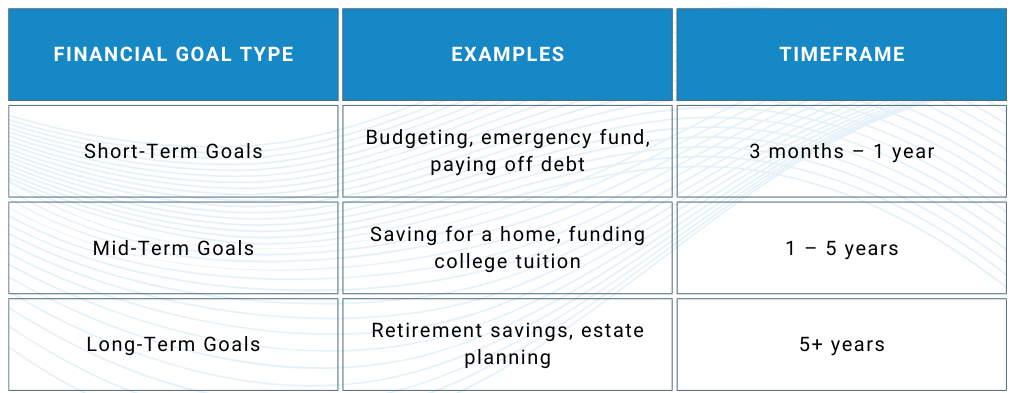

Comparison of Financial Goals and Timeframes

The table below outlines different types of financial goals, examples of each, and how long they typically take to achieve.

This breakdown makes it easier to set priorities and allocate financial resources efficiently. Identifying whether a goal falls into short-term, mid-term, or long-term planning helps in building a financial strategy that balances immediate needs with future aspirations.

How to Financially Plan for the New Year?

Creating a strong financial plan for the new year involves assessing where you stand, identifying areas for improvement, and taking actionable steps to meet your goals. Here’s how to start the year on the right financial footing:

Evaluate Your Current Financial Health

- Review Income, Expenses, and Current Savings: Take a detailed look at your earnings, spending habits, and savings to understand your financial baseline.

- Assess Progress on Previous Financial Goals: Reflect on your achievements from last year and identify any areas where you fell short. Take a look at month-to-month progress and come up with financial goals to work towards. This insight will help guide your priorities moving forward.

Create a Personalized Financial Plan

- Identify Areas to Cut Unnecessary Expenses: Look for subscriptions, services, or habits that no longer add value and redirect those funds toward more meaningful goals.

- Allocate Funds Toward Savings, Investments, and Debt Repayment: Divide your available resources strategically to ensure balanced progress across all fronts.

- Automate Savings to Stay Consistent: Set up automatic transfers to savings and investment accounts to make progress seamless and reduce the temptation to spend.

Adjust Investments and Retirement Contributions

- Maximize Contributions to Retirement Accounts: Take advantage of opportunities to contribute to 401(k)s, IRAs, or HSAs, especially if your employer offers matching contributions.

- Diversify Investments to Align with Long-Term Goals: Review your investment portfolio to ensure it reflects your risk tolerance, time horizon, and financial objectives for the year.

Tips to Stay on Track with Financial Goals

Achieving your financial goals requires consistency, discipline, and regular check-ins. Here are some practical tips for financial success to help you stay on course:

- Regularly Review and Adjust Your Budget: Make it a habit to revisit your budget each month or quarter. Life changes, and your budget should reflect those changes to stay aligned with your financial goals.

- Use Tools or Apps to Monitor Spending and Savings: Leverage technology to track your finances in real-time. Budgeting apps and financial management tools can help you visualize your progress and identify areas for improvement.

- Seek Accountability from a Trusted Advisor or Partner: Share your goals with someone you trust, such as a financial advisor, a partner, or even a friend. They can provide support, encouragement, and guidance to help you stay motivated.

With these tips, you can maintain focus on your financial goals, adapt to changes, and celebrate your progress throughout the year.

Conclusion: Achieve Financial Success with Insight Wealth Strategies

The new year is your chance to take control of your finances and set a course for lasting success. With careful planning and the right guidance, you can create a personalized strategy that aligns with your lifestyle and supports your long-term goals. At Insight Wealth Strategies, we are committed to helping you navigate the complexities of financial planning, so you can focus on what matters most.

Contact us today to take the next step toward financial security. Whether you’re in Houston or San Ramon, we’re here to provide tailored solutions that fit your needs.

Learn more about wealth management in Houston.

Discover our wealth management services in San Ramon.

Start your journey toward financial success with Insight Wealth Strategies.

Reviewed by,

Chad Seegers, CRPC®

Chad began his career with Sagemark Consulting in 2005 and then became a Select member of Sagemark’s Private Wealth Services which operated as a national resource for financial planners focusing on Advanced Strategies in the High Net Worth marketplace. Chad then began his partnership with Insight Wealth Strategies in 2013 focused on retirement planning primarily with Oil and Gas employees and executives. His primary areas of expertise are retirement, estate, and investment strategies as he serves as Investment Strategist for the financial planning team.

Insight Wealth Strategies, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Insight Wealth Strategies, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Insight Wealth Strategies, LLC unless a client service agreement is in place.

Insight Wealth Strategies, LLC (IWS) and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.