A Look Back at Market Behavior in 2022

- Written by: Cole Durkin, CFA®

- January 19, 2023

2022 was an interesting year when looking at overall market performance and portfolio construction. Let’s take a look at what the root causes were and what we can see for 2023.

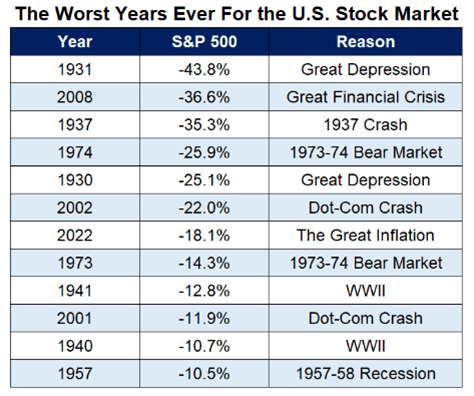

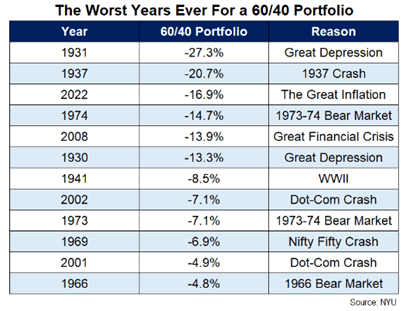

Though we are aware of equity drawdowns and have experienced them before, the combination of equity and fixed income drawdowns was significant due to both parts of a portfolio experiencing declines at the same time. Last year was the third worst year for portfolio construction, coming in behind the Great Depression and 1937 Great Crash.

What was the cause?

With a cooling economy, high inflation and increasing rates, this caused negative impacts on the equity and fixed income markets. The historically aggressive rate hikes from the Federal Reserve continued in an attempt to slow relentless inflation. The idea is higher rates will slow demand and the economy, which leads to a decrease in inflation.

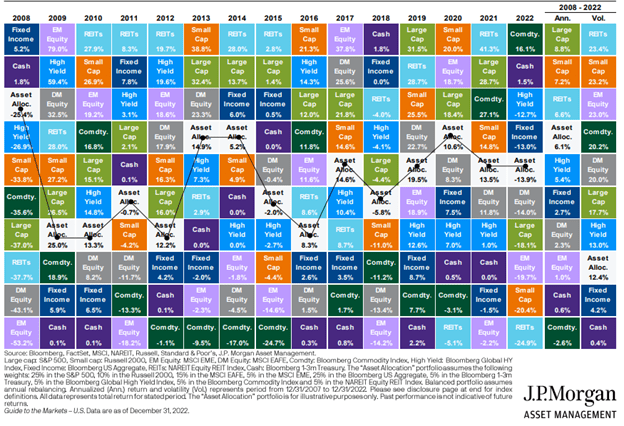

Looking at asset class returns, the only thing that worked was commodity exposure with cash coming in second. This was a difficult year for asset allocation all around. Usually the fixed income market will lighten the blow from equity drawdown, but in this unique year, both saw hard times.

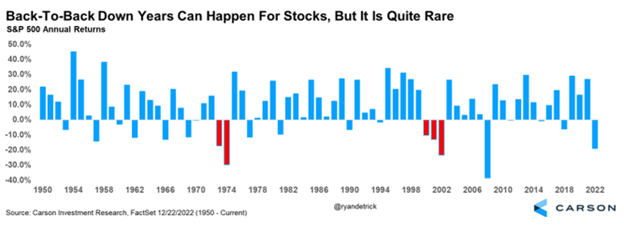

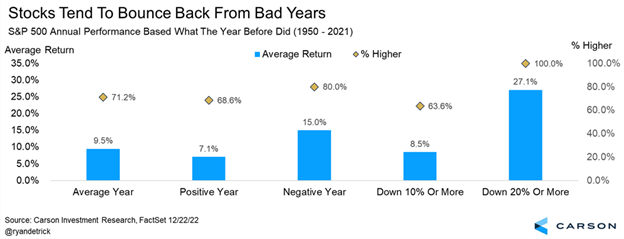

Making a 1-year forecast has a low probability as we’ve seen in recent years, as the one thing that never changes is the unpredictable nature of the world and how we react to those events. We can look at what the data tells us our highest probability decisions are. Below is data going back to 1950 and shows that back-to-back years can happen but are rare.

Here is what has historically happened after years with average and down more than 20% returns.

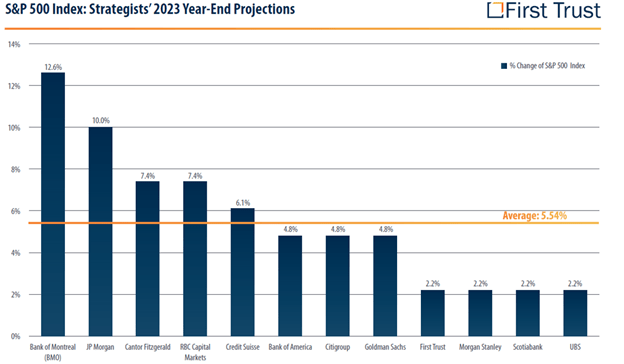

Here are the range of projections from various firms. As you can see, it is a wide range and difficult to say where the market ends up.

So, with so many unknowns, how do you navigate this market or any other market environment for that matter? What are your objectives? How can we achieve those objectives with the highest probability in this environment? What type of market movement can you and your plan handle? We take a holistic view of your financial situation to give you the best probability of meeting your objectives through different market cycles, as challenging as they may be. If you have questions about your investments, reach out to your advisor and schedule a meeting today!

Written by,

Cole Durkin, CFA®

Cole began his career with Sagemark Consulting in 2016 as an investment support specialist where he assisted with portfolio management for a team of advisors. He joined the Houston Insight Wealth Strategies team in 2018, where his responsibilities consist of researching, constructing, and managing portfolios for clients and advisors. Cole earned his BBA in Finance from Lamar University. Following his undergraduate degree, he earned his Master’s in Investment Management and Financial Analysis from Creighton University. Also, he is a member of the Global Interdependence Center. Lastly, he has previously passed his Series 7 and Series 66.

Insight Wealth Strategies, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Insight Wealth Strategies, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Insight Wealth Strategies, LLC unless a client service agreement is in place.

Insight Wealth Strategies, LLC (IWS) and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.