Benefits of Charitable Giving

Table of Contents

Aligning your philanthropic efforts with strategic financial planning offers a unique opportunity to make a meaningful impact while also enhancing your financial well-being. Beyond the emotional satisfaction of giving back to causes you care about, charitable giving can provide significant tax benefits that help you maximize the value of your contributions. In this guide, we explore the key benefits of charitable giving, its impact on your taxes, and practical steps to ensure your generosity aligns with your overall financial goals.

How Charitable Giving Enhances Your Financial and Emotional Well-being

Emotional Fulfillment and Community Impact

Charitable giving allows you to connect with causes that resonate with your values, providing a sense of joy and purpose. Whether it’s supporting education, healthcare, or environmental conservation, your contributions have the power to create positive change in the world.

Beyond personal satisfaction, giving back to charity strengthens communities by funding essential programs and resources. By following these tips for charitable giving, your generosity can leave a lasting legacy, inspiring others to follow your example and building a culture of compassion and support.

Financial Benefits of Giving Back

Philanthropy isn’t just about emotional rewards—it also offers tangible financial advantages. One of the most notable benefits is the potential reduction in taxable income. By strategically planning your contributions, such as donating appreciated assets or making qualified charitable distributions, you can minimize your tax burden while supporting the causes you love.

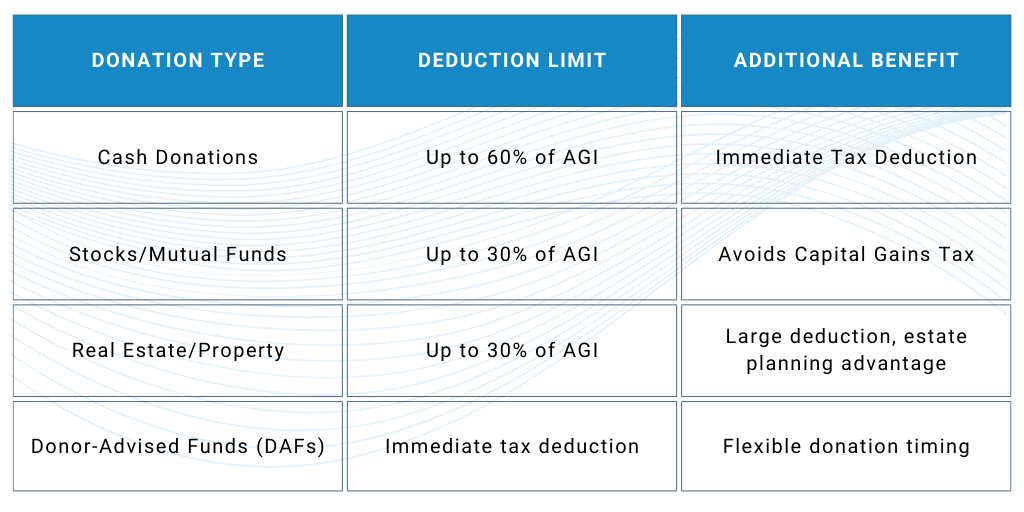

Donor-advised funds (DAFs) offer an excellent vehicle for long-term giving strategies. These accounts allow you to contribute funds now, take advantage of immediate tax deductions, and decide over time which charities to support. This flexibility makes DAFs an ideal option for individuals seeking to align philanthropy with their financial goals.

Do You Get Benefits for Donating to Charity?

Charitable donations can provide valuable benefits, but eligibility for tax deductions requires meeting specific criteria. To qualify, your contributions must be made to organizations classified as 501(c)(3) by the IRS1. These organizations include charities, religious institutions, and certain educational or scientific institutions. Always ensure the organization you support meets these requirements to maximize the potential tax advantages.

Donor-advised funds (DAFs) offer an excellent vehicle for long-term giving strategies. These accounts allow you to contribute funds now, take advantage of immediate tax deductions, and decide over time which charities to support. This flexibility makes DAFs an ideal option for individuals seeking to align philanthropy with their financial goals.

How Much Does a Charitable Donation Reduce Taxes?

Tax Deduction Limits Explained

The tax benefits of charitable donations depend on your adjusted gross income (AGI) and the type of donation. The IRS sets limits on how much of your contribution you can deduct in a given year, typically ranging from 20% to 60% of your AGI, depending on the nature of the donation and the recipient organization2. For example:

- Cash donations to public charities are deductible up to 60% of your AGI2.

- Donations of appreciated assets, such as stocks, are often capped at 30% of your AGI3.

- Contributions to private foundations may have lower deduction limits, often 20%2.

For instance, if you donate $10,000 in cash to a qualified charity and your AGI is $100,000, you can deduct up to $6,000 in that tax year. However, if you donate $10,000 in appreciated stocks, you may only be able to deduct $3,000, but you would also avoid paying capital gains tax on the stock’s appreciation—potentially making it a more tax-efficient choice.

If your donations exceed these limits in a single year, the IRS allows you to carry over unused deductions for up to five additional tax years, ensuring you can maximize the value of your charitable giving over time.

Types of Donations and Their Tax Benefits

Not all donations are created equal when it comes to tax advantages. Here’s how different types of charitable contributions can benefit you:

- Monetary Contributions: Cash donations are straightforward and offer immediate tax deductions, making them a popular choice for many donors.

- Non-Cash Assets: Donating appreciated assets, such as investments, stocks or mutual funds, can provide a double benefit: avoiding capital gains taxes while also receiving a deduction for the asset’s full fair market value.

- Property and In-Kind Gifts: Contributions of real estate, vehicles, or other valuable items can also yield substantial tax savings. These donations often require additional appraisal and documentation but can significantly reduce your tax liability when structured correctly.

For example, donating a rental property valued at $200,000 that originally cost $100,000 allows you to deduct the full $200,000 fair market value, avoiding capital gains tax on the $100,000 appreciation—making it a powerful wealth management strategy.

By understanding these nuances, donors can make informed decisions that maximize the financial and philanthropic impact of their charitable contributions.

Is It Worth It to Put Donations on Taxes?

The Case for Itemizing Deductions

Determining whether to claim charitable donations on your taxes often depends on whether you itemize deductions. For many taxpayers, the standard deduction offers simplicity and significant tax savings. However, if your deductible expenses, including charitable donations, exceed the standard deduction amount, itemizing can provide greater financial benefits.

For example:

- In 2025, the standard deduction is $15,000 for single filers and $30,000 for married couples filing jointly4.

- If your charitable contributions, mortgage interest, medical expenses, and other eligible deductions exceed these amounts, itemizing could result in substantial tax savings.

Ensuring Proper Documentation

To claim charitable donations on your taxes, maintaining accurate documentation is crucial. The IRS requires receipts or acknowledgment letters for any contribution of $250 or more5. These records should include:

- The organization’s name.

- The donation amount or description of non-cash contributions.

- A statement confirming that no goods or services were received in exchange for the donation (if applicable).

For non-cash donations valued over $500, additional forms such as Form 8283 may be required. Appraisals may also be necessary for property or assets exceeding a specific value.

Integrating Charitable Giving into Your Financial Plan

Charitable giving can play a pivotal role in your overall financial strategy, aligning your philanthropic goals with your long-term wealth management objectives. By integrating generosity into your financial plan, you not only support meaningful causes but also enhance your financial legacy, potentially reducing tax burdens and optimizing your assets over time.

Strategic tools such as planned giving, donor-advised funds (DAFs), and charitable trusts offer tailored solutions to maximize the impact of your giving:

- Planned Giving: This approach involves structuring donations to occur over time or as part of your estate plan, ensuring your contributions align with your financial needs and legacy goals.

- Donor-Advised Funds (DAFs): These accounts allow you to contribute funds, receive an immediate tax deduction, and distribute grants to charities at your convenience. DAFs provide flexibility, tax efficiency, and centralized management of your giving.

- Charitable Trusts: Options like charitable remainder trusts (CRTs) or charitable lead trusts (CLTs) enable you to support causes while retaining income streams or tax advantages for yourself or your beneficiaries.

Conclusion – Partner with Insight Wealth Strategies for Effective Financial Planning

Charitable giving is more than an act of generosity, it’s a powerful tool that fosters personal fulfillment while contributing to your long-term financial growth. By aligning your philanthropic efforts with a strategic financial plan, you can maximize the emotional and financial benefits of giving back.

At Insight Wealth Strategies, we specialize in designing personalized financial plans tailored to your unique goals. Whether you’re looking to incorporate charitable giving, optimize tax strategies, or build a comprehensive wealth management plan, our team is here to help.

Take the first step toward achieving your financial and philanthropic goals. Learn more about our financial planning services in Houston or San Ramon financial planning services. Let’s create a plan that empowers your generosity while securing your financial future.

Reviewed by,

Chad Seegers, CRPC®

Chad began his career with Sagemark Consulting in 2005 and then became a Select member of Sagemark’s Private Wealth Services which operated as a national resource for financial planners focusing on Advanced Strategies in the High Net Worth marketplace. Chad then began his partnership with Insight Wealth Strategies in 2013 focused on retirement planning primarily with Oil and Gas employees and executives. His primary areas of expertise are retirement, estate, and investment strategies as he serves as Investment Strategist for the financial planning team.

Charitable Giving Guidance & Tips

Explore articles and resources designed to help you and your loved ones give intentionally, optimize tax benefits, and make a meaningful impact through strategic charitable planning.

Sources:

- https://www.irs.gov/charities-non-profits/charitable-organizations/exemption-requirements-501c3-organizations

- https://www.irs.gov/charities-non-profits/charitable-organizations/charitable-contribution-deductions

- https://www.schwabcharitable.org/non-cash-assets/publicly-traded-securities

- https://www.irs.gov/newsroom/irs-releases-tax-inflation-adjustments-for-tax-year-2025

- https://www.irs.gov/charities-non-profits/charitable-organizations/charitable-contributions-written-acknowledgments

Insight Wealth Strategies, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Insight Wealth Strategies, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Insight Wealth Strategies, LLC unless a client service agreement is in place.

Insight Wealth Strategies, LLC (IWS) and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.