The Benefits of Dollar-Cost Averaging

The Benefits of Dollar-Cost Averaging Dollar-cost averaging (DCA) is a strategy that can help reduce the impact of volatility when investing in securities. Instead of making a lump sum investment, investors can use dollar-cost averaging to break up the investments into equal smaller amounts over a certain period. Utilizing dollar-cost averaging can help an investor […]

Examining the Roth IRA

Examining the Roth IRA When planning for retirement, you have several options to consider when deciding which type of retirement account to fund. You may have the option of contributing to a defined contribution plan through an employer that includes a 401(k), and for those who do not have that option, an Individual Retirement Account […]

The Importance of Diversification in Investing

The Importance of Diversification in Investing It may sound a bit cliché, but the adage “don’t put all your eggs in one basket” rings especially true when it comes to investing. In a perfect world, your investments would only increase in value day after day, month after month and year after year. In reality, there will likely be periods when some […]

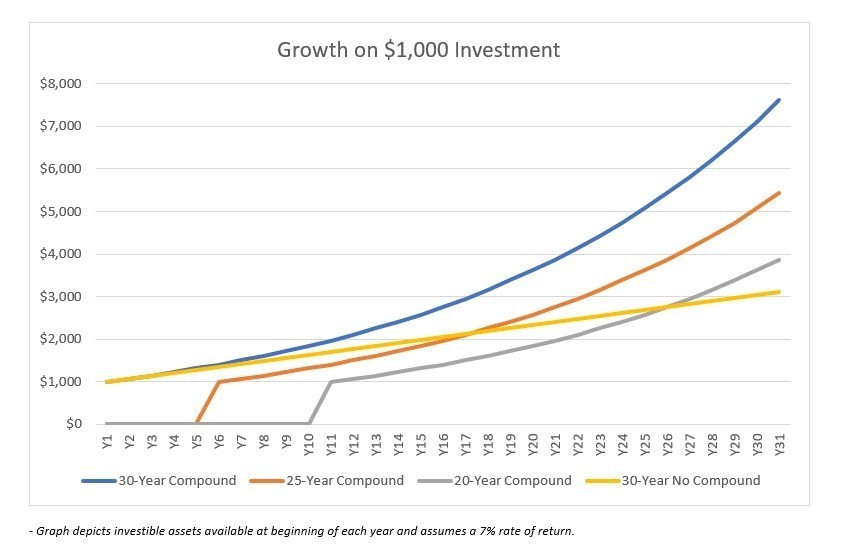

Utilizing the Power of Compound Interest

Utilizing the Power of Compound Interest For investors, there is unfortunately no magic wand or crystal ball that will lead to riches. But saving and investing wisely can open individuals up to something almost as powerful. It is called compound interest, and it is one of the surest ways to build wealth. All it takes […]

Financial New Year’s Resolutions for 2020

Financial New Year’s Resolutions for 2020 Making New Year’s resolutions is a great way to plan to be better in the new year. Unfortunately, sticking with those resolutions isn’t as easy as setting them. Whatever is on your list for the upcoming year, whether it is to get in shape, spend more time with family […]

Should I Take My Pension as a Lump Sum or an Annuity?

Should I take My Pension as a Lump Sum or an Annuity? You are getting ready to retire, and you have a defined benefit pension that will kick in once you stop working. You may have the option of taking the pension in the form of a one-time lump sum distribution or as lifetime monthly […]

Understanding the Required Minimum Distribution

Understanding the Required Minimum Distribution In an effort to encourage workers to save for retirement, the United States government allows individuals to save part of their income tax-deferred into retirement accounts. Workers do not have to pay taxes on these funds or on the investment gains until the money is withdrawn from the account as […]

Discussing the In-Service Rollover

Discussing the In-Service Rollover Jump to In-Service Rollover FAQs A 401(k) plan is a great vehicle for employees to save for retirement. The money invested into this employer-sponsored qualified retirement plan is saved pre-tax and grows on a tax-deferred basis. Taxes on this deferred income are not paid until the money is withdrawn from the […]

Insight2Markets: Inversion Diversion

Inversion Diversion A frequent question of late is what to make of a flattening yield curve and what action should we take? In short – the yield curve is used as a tool which can illustrate high probability recession risk with considerable lead time of about a year and should not affect drastic portfolio decisions […]

Sequence of Returns

Sequence of Returns One of the biggest risks to a successful retirement plan is sequence of returns risk. Also known as timing risk, sequence of returns risk is the potential for lower or negative returns during the initial period in which the investor makes withdrawals from a portfolio. If left undefended, sequence of returns risk […]