Employee Benefit Plan Strategies:

Build a Stronger Financial Future for Your Team

Table of Contents

A well-structured employee retirement plan is more than just a benefit—it’s a tool that can strengthen your business. Offering a robust retirement plan can add to your workplace benefits, reduce costs, and improve employee retention by providing long-term financial security. By carefully selecting and optimizing your plan, businesses can not only attract and retain top talent but also take advantage of tax benefits and cost-effective solutions. Understanding your options and making informed decisions will ensure your retirement plan delivers the most value for both your employees and your company.

What Is a Workplace Retirement Plan?

A workplace retirement plan is a benefit program offered by employers to help employees save and invest for their future. These plans provide a structured way for workers to contribute a portion of their earnings toward retirement, often with employer contributions or tax advantages that enhance their savings potential.

Common Types of Workplace Retirement Plans

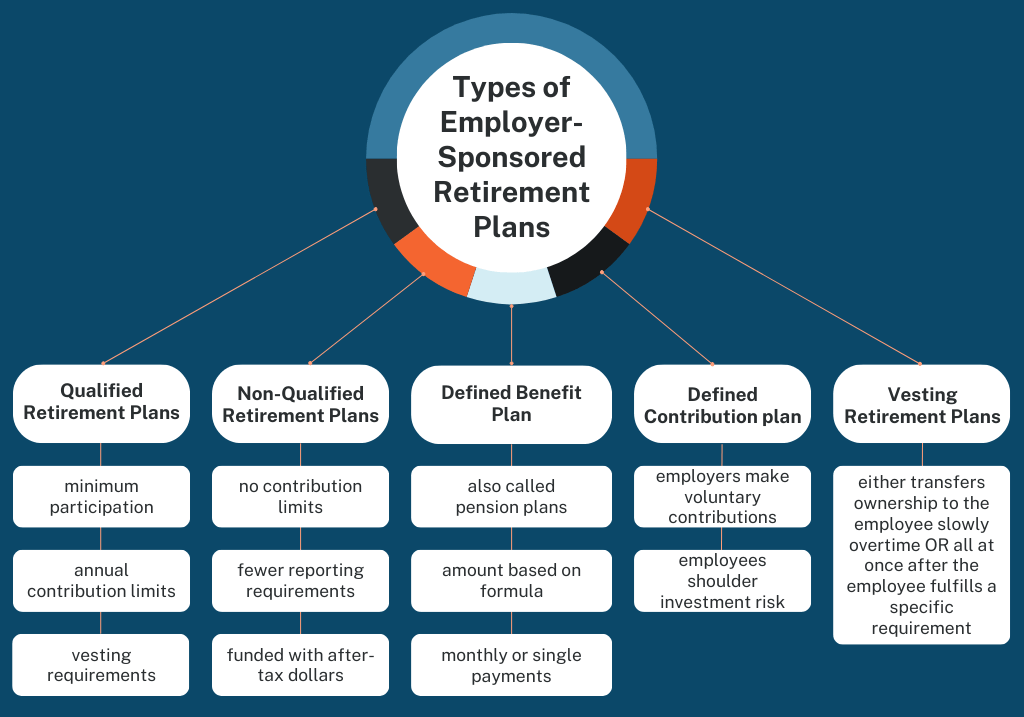

Employers have several options when it comes to structuring retirement benefits for their workforce. Some of the most common workplace retirement plans include:

- 401(k) Plans – One of the most widely used retirement plans, 401(k) accounts allow employees to contribute pre-tax or Roth (after-tax) dollars, often with employer matching contributions.

- 403(b) Plans – Similar to 401(k) plans, these are designed for employees of nonprofit organizations, public schools, and certain tax-exempt entities.

- SIMPLE IRAs – A Savings Incentive Match Plan for Employees (SIMPLE IRA) is ideal for small businesses with fewer than 100 employees. It offers simplified administration and requires employer contributions.

- SEP IRAs – A Simplified Employee Pension (SEP IRA) allows employers—particularly small business owners and self-employed individuals—to make tax-deductible contributions for themselves and their employees.

Tax Advantages for Employers and Employees

Workplace retirement plans offer significant tax benefits:

- For Employees: Contributions to traditional plans (e.g., pre-tax 401(k), SIMPLE IRAs, and SEP IRAs) reduce taxable income and grow tax-deferred until withdrawal. Roth options allow for tax-free growth and tax-free withdrawals in retirement.

- For Employers: Businesses can often deduct contributions made to employee retirement plans, reducing overall taxable income. Many plans also come with tax credits for setting up and maintaining a retirement program, making them a cost-effective benefit option.

By choosing the right plan, businesses can improve their compensation packages while helping employees build a secure financial future.

Why Offering a Retirement Plan Matters for Businesses

Providing a workplace retirement plan isn’t just about helping employees save for the future—it’s a strategic business decision that can enhance recruitment efforts, improve employee well-being, and offer valuable tax benefits. A well-designed retirement plan can position a company as an employer of choice while also fostering a financially secure and motivated workforce.

Attract and Retain Top Talent

In today’s competitive job market, employees look beyond salary when evaluating job opportunities. Retirement benefits play an important role in attracting and retaining high-quality talent. Offering a strong retirement plan can:

- Differentiate your company from competitors that provide limited or no retirement benefits.

- Increase employee loyalty, reducing turnover and associated hiring costs.

- Demonstrate long-term commitment to employee well-being, enhancing workplace satisfaction.

Many job seekers, especially those planning for long-term financial security, prioritize companies with solid retirement offerings. Businesses that provide 401(k) matching or other retirement incentives often have an edge in recruitment and employee retention.

Boost Employee Financial Wellness

Financial stress can significantly impact an employee’s productivity, engagement, and overall well-being. By offering a structured retirement savings plan, employers can help alleviate these concerns and support financial security.

- Employees with access to retirement plans are more likely to save consistently and feel confident about their future.

- Reduced financial stress leads to increased focus, job satisfaction, and overall workplace morale.

- Workforce stability improves when employees are financially secure and not constantly searching for better benefits elsewhere.

Tax Advantages for Employers

Beyond employee benefits, offering a retirement plan provides substantial tax advantages for businesses:

- Employer contributions to retirement plans are tax-deductible, reducing the company’s taxable income.

- Small businesses may qualify for tax credits when establishing a new retirement plan under the SECURE Act, helping offset setup and administrative costs.

- Certain plans allow for profit-sharing contributions, providing flexibility in how much the business contributes each year.

Choosing the Right Retirement Plan for Your Business

Selecting the right workplace retirement plan needs careful consideration of your company’s size, budget, and long-term goals. Whether you run a small business with a handful of employees or a larger organization, understanding your options helps you maximize benefits while managing costs effectively.

Consider Company Size and Budget

Different retirement plans come with varying administrative requirements and costs, making some more suitable for small businesses while others cater to larger organizations.

- Small Businesses & Self-Employed:

- SIMPLE IRAs – Ideal for businesses with fewer than 100 employees, offering lower costs and mandatory employer contributions.

- SEP IRAs – Best for sole proprietors or small businesses wanting to contribute on behalf of employees without the complexity of a 401(k).

- Mid-Sized to Large Businesses:

- 401(k) Plans – Offer greater flexibility, including employer matching and Roth contributions, but require compliance with regulations such as nondiscrimination testing.

- 403(b) Plans – Designed for nonprofit organizations and public-sector employees, providing similar benefits to a 401(k) with streamlined regulatory requirements.

For businesses with limited budgets, low-cost plans like SEP IRAs and SIMPLE IRAs provide an easy way to offer retirement benefits without extensive administrative overhead. Larger companies looking to maximize employee retention may benefit from a customizable 401(k) with matching contributions and other features.

Employer Matching and Contributions

One of the biggest incentives for employees to participate in a workplace retirement plan is employer contributions. Offering a match or profit-sharing contributions can encourage higher participation and help employees build their retirement savings faster.

- Matching Contributions – Employers can match employee contributions up to a certain percentage (e.g., 50% of contributions up to 6% of salary). This boosts employee engagement and retention.

- Profit-Sharing Options – Some plans, like 401(k)s, allow employers to contribute based on company profitability, offering flexibility in slower financial years.

- Vesting Schedules – Employers can set vesting schedules, where employees earn ownership of employer contributions over time. This incentivizes long-term employment.

Matching contributions not only benefit employees but also provide tax advantages for employers, as contributions are typically tax-deductible.

Plan Flexibility and Customization

Businesses should consider how much flexibility they need when selecting a retirement plan. Some plans offer features that allow companies to tailor benefits to their financial situation and workforce needs.

- Roth Contributions – Employees can contribute after-tax dollars to a Roth 401(k), allowing for tax-free withdrawals in retirement.

- Profit-Sharing Contributions – Some plans, like 401(k)s and SEP IRAs, allow employers to contribute discretionary amounts, making it easier to adjust based on company performance.

- Automatic Enrollment – Employers can set up automatic enrollment to boost participation rates while still allowing employees to opt out.

A retirement plan that aligns with your business goals and financial capabilities helps ensure that both the company and employees get the most out of their benefits.

How to Improve Employee Participation in Retirement Plans

Even with a well-structured retirement plan in place, employee participation can vary. Many workers may not fully understand the benefits or may hesitate to contribute due to financial concerns. Employers can take proactive steps to boost engagement and encourage employees to take advantage of the retirement plan offered to them.

Offer Financial Education and Resources

One of the biggest barriers to retirement savings is a lack of understanding about how these plans work. Providing employees with financial education can help them make informed decisions and feel more confident about saving for retirement.

- Host workshops, webinars, or lunch-and-learn sessions to explain how the company’s retirement plan works.

- Offer online tools, calculators, and educational materials to illustrate the impact of contributions over time.

- Highlight the power of compound interest, showing how even small contributions can grow significantly over decades.

- Provide one-on-one financial guidance to help employees tailor their savings strategy to their personal financial goals.

Simplify Enrollment and Contributions

The easier it is for employees to enroll and contribute, the more likely they are to participate. Many workers put off enrolling in a retirement plan simply because the process seems complex or overwhelming.

- Automatic Enrollment – Employees are automatically enrolled in the plan unless they opt out, increasing participation rates significantly.

- Default Contribution Rates – Setting a reasonable default contribution percentage (e.g., 3% to 6%) ensures employees start saving immediately.

- Payroll Deductions – Employees can contribute seamlessly through automatic payroll deductions, making saving effortless.

By streamlining enrollment and offering hassle-free contributions, businesses can help employees take the first step toward retirement savings without hesitation.

Provide Matching Contributions

Employer matching contributions are one of the strongest incentives for employees to participate in a retirement plan. Many employees are more likely to contribute when they know they’ll receive additional “free money” from their employer.

- Encourage higher savings rates by matching a percentage of employee contributions (e.g., a 100% match on the first 3% or 50% on the first 6%).

- Educate employees on the value of the match, emphasizing that they are leaving money on the table if they don’t participate.

- Gradually increase the match over time to encourage long-term participation and higher savings.

An employer match not only helps employees build retirement savings faster but also reinforces the company’s commitment to their financial well-being.

Maximizing Cost Savings While Enhancing Benefits

Providing a high-quality retirement plan doesn’t have to be costly. Employers can balance affordability with strong benefits by carefully selecting plan features, optimizing investment options, and ensuring compliance. By taking a strategic approach, businesses can reduce expenses while maximizing the value of their retirement plan for employees.

Choose Low-Fee Investment Options

Investment fees can have a significant impact on long-term retirement savings, both for employees and the employer. Selecting low-cost investment options helps keep expenses in check while allowing savings to grow more efficiently.

- Opt for index funds or low-cost mutual funds to minimize expense ratios and administrative fees.

- Compare plan providers and fee structures to ensure the most cost-effective options are available.

- Educate employees on investment choices to help them select funds that align with their risk tolerance and long-term goals.

Work with a Financial Advisor to Optimize Plan Structure

A financial advisor or retirement plan consultant can help businesses design a plan that meets both employer and employee needs while remaining cost-effective. Working with an advisor can provide:

- Guidance on plan design, including contribution strategies, vesting schedules, and tax-efficient features.

- Insights on regulatory compliance, ensuring the plan adheres to Department of Labor (DOL) and IRS guidelines.

- Assistance with investment selection to balance risk and cost while maximizing growth potential.

With knowledgeable advice, businesses can structure a retirement plan that optimizes both costs and benefits for all participants.

Get Knowledgeable Guidance on the Right Retirement Plan for Your Business

Contact Insight Wealth Strategies, LLC today to explore the best retirement plan solutions for your business. Our experienced team can help you optimize costs, enhance benefits, and ensure long-term financial security for your employees.

Reviewed by,

Chad Seegers, CRPC®

Chad began his career with Sagemark Consulting in 2005 and then became a Select member of Sagemark’s Private Wealth Services which operated as a national resource for financial planners focusing on Advanced Strategies in the High Net Worth marketplace. Chad then began his partnership with Insight Wealth Strategies in 2013 focused on retirement planning primarily with Oil and Gas employees and executives. His primary areas of expertise are retirement, estate, and investment strategies as he serves as Investment Strategist for the financial planning team.

Insight Wealth Strategies, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Insight Wealth Strategies, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Insight Wealth Strategies, LLC unless a client service agreement is in place.

Insight Wealth Strategies, LLC (IWS) and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.