A Guide to Navigating Finances in

Blended Family Households

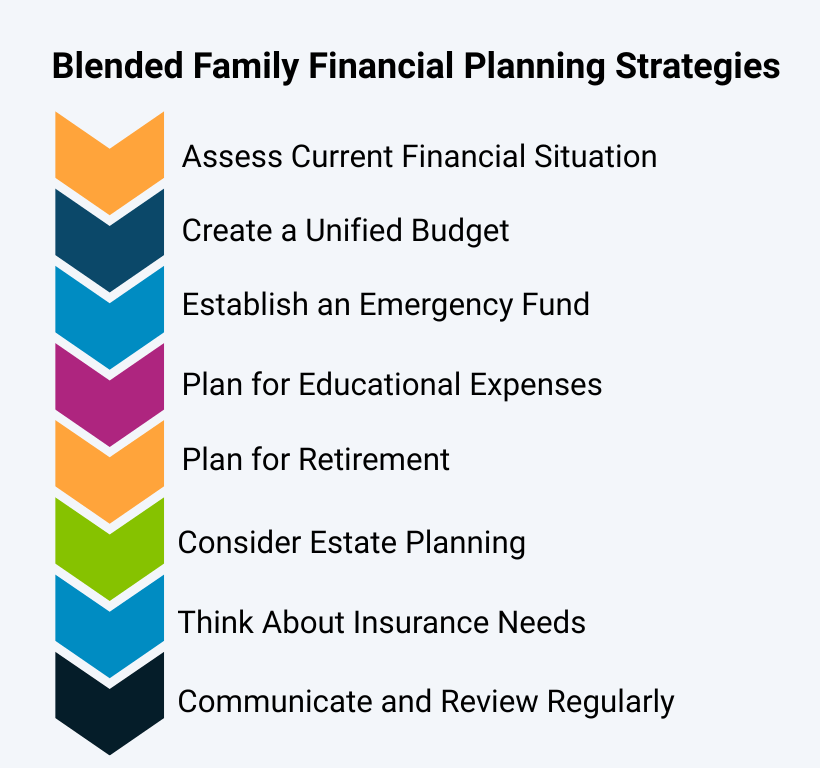

Managing finances in a blended family needs thoughtful coordination, honest conversations, and a unified approach to both day-to-day expenses and future planning. With multiple family dynamics, past financial obligations, and varying priorities in the mix, it’s easy for tensions to arise if you don’t have a clear financial planning strategy. This guide explores the financial challenges unique to blended families—along with some practical tips to build a shared path forward, strengthen trust, and create long-term financial harmony.

Understanding Blended Family Finances

What is a Blended Family Household?

A blended family household is one in which one or both partners bring children from previous relationships into a new partnership or marriage. These families can take many forms—such as a couple raising one partner’s children, or both partners combining families and raising children together. In these households, financial responsibilities are often shared in nontraditional ways, with differing expectations around support for biological and stepchildren, managing separate or combined finances, and honoring past financial commitments.

Why Financial Planning Looks Different

Blended families can face unique financial considerations that can make planning more complex than in traditional households. From child support and alimony to overlapping timelines for saving for college or managing dual households, the financial picture often involves multiple layers. Differences in spending habits, savings goals, and past financial experiences can also create tension without a shared plan. Establishing clear financial boundaries and long-term strategies early on can help reduce misunderstandings, support better communication, and foster a sense of unity when it comes to managing household finances.

What are the 3 Main Issues Common with a Blended Family?

Lack of Unified Financial Goals

In blended families, partners often come into the relationship with different financial priorities. One may be focused on retirement savings, while the other wants to help a child purchase their first car or pay for college. Without alignment, these differing goals can lead to confusion, resentment, or financial strain. Establishing shared financial objectives—both short-term and long-term—helps create clarity and ensures both partners feel heard and supported in their planning.

Disagreements Over Asset Ownership and Inheritance

Estate planning can be especially sensitive in blended families. Questions like “Who inherits what?” or “Is it fair to prioritize my biological children?” can lead to misunderstandings if not addressed early. Disagreements may arise when one partner expects to leave assets to their own children, while the other envisions a more equal distribution across the entire family. Clear legal tools—such as wills, living trusts, and beneficiary designations—can help formalize intentions and prevent future conflict, but open discussions are needed to avoid surprises down the road.

Communication Barriers Around Money

Talking about money isn’t always easy—especially when it involves prior relationships, debts, or family expectations. In blended households, avoiding financial conversations out of discomfort or fear of conflict can quickly derail even the best intentions. Without transparency, misunderstandings can grow and trust can erode. Regular, judgment-free check-ins about finances can help build a stronger foundation and ensure both partners feel involved in the household’s financial direction.

Tips for Managing Finances as a Blended Family

Start with Honest Conversations

Begin with open, judgment-free discussions about income, spending habits, debts, and financial goals. These talks are best had early in the relationship—and revisited often—as circumstances and priorities change.

Decide How to Combine (or Separate) Finances

Every blended family is different. Some choose to fully merge finances, others maintain separate accounts, and many land somewhere in between. The key is choosing a system that feels fair, transparent, and manageable for both partners.

Build a Budget That Supports Everyone

Create a shared budget that covers joint expenses—like housing and groceries—while also accounting for obligations such as child support, alimony, or saving for kids from previous relationships. For example, one partner may contribute more to household costs if the other is managing school fees for their children. Balance and flexibility are essential.

Planning for the Future: Estate, Insurance & Education

Update Wills, Beneficiaries & Legal Documents

Blended families should review and revise wills, trusts, and beneficiary designations to reflect their current situation. A common mistake is leaving an ex-spouse or outdated beneficiary on a life insurance policy or retirement account—something that can create unintended outcomes. Knowing the differences between a trust and a will is essential for preventing mistakes that can interrupt your estate planning checklist.

Consider Life Insurance & Long-Term Care

Life insurance is essential when children rely on one or both incomes. It can help ensure financial stability for all dependents—biological or stepchildren—in the event of a loss. Long-term care planning is also worth discussing, especially if caregiving may affect multiple households.

Education Planning for All Children

Whether children are from previous or current relationships, education planning should be thoughtful and equitable. 529 plans are a popular option for tax-advantaged college savings. Partners should be clear and transparent about how much they intend to contribute for each child’s future and teach kids about money management.

Work with a Financial Advisor Who Understands Blended Families

Blended families have unique financial dynamics that deserve specialized attention. Working with a financial advisor who understands these complexities can help you create a wealth management and retirement plan that respects everyone’s needs while aligning with your long-term goals. From balancing priorities to managing estate considerations, personalized guidance can provide clarity, reduce conflict, and keep your family’s finances on track. Having estate planning strategies for high net worth individuals is especially important in blended families, so be sure to find the right solution to meet your needs.

Create Harmony in Your Household Through Thoughtful Financial Planning

A strong financial plan can ease stress and bring stability to blended families navigating complex relationships and responsibilities. Clear communication, aligned goals, and proactive legal and financial planning are key to creating unity and protecting your family’s future.

At Insight Wealth Strategies, we understand the unique challenges blended families face—and we’re here to help you build a plan that supports everyone involved. Find wealth management solutions in Houston and San Ramon to create a custom financial plan for your family’s needs.

Contact Insight today to build a financial plan that reflects your family’s values.

Reviewed by,

Brian Stormont, CFP®

Brian Stormont is a comprehensive, fee-only financial advisor with Insight Wealth Strategies who began his career in the financial industry in 2000. His expertise encompasses retirement planning, investment planning, estate planning, and high-level strategies to help business owners and individuals minimize their income taxes.

Insight Wealth Strategies, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Insight Wealth Strategies, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Insight Wealth Strategies, LLC unless a client service agreement is in place.

Insight Wealth Strategies, LLC (IWS) and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.