Financial Wellness (Explanation, Tips & Benefits)

In today’s competitive hiring environment, it is important for businesses to offer their employees competitive benefits in order to lure and retain top talent.

Many companies offer employees benefits packages that include savings plans, pensions and stock options, but employees are often left to their own devices when implementing decisions on their financial future.

A 2013 study by the American Psychological Association indicated 71 percent of adults list their most common source of stress as money, and according to the Consumer Financial Protection Bureau, there is evidence that suggests a financially capable workforce is more satisfied, engaged, and productive for their employers. (1)

Financial stress can have an adverse effect on employees both off and on the job. It can distract employees at work, impact performance and reduce worker productivity.

A 2012 survey revealed about 20 percent of employees admitted skipping work in the past year to deal with a financial problem. (2)

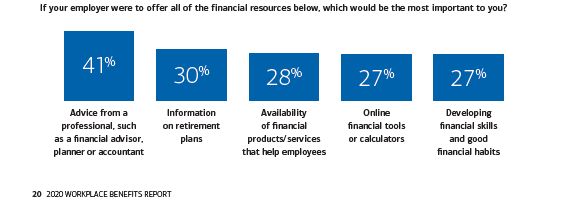

Employers already invest heavily in health and retirement benefits for employees to help them secure a financial future, so the natural continuation of this investment is to help employees with short-term and long-term financial planning and with financial solutions to help employees reach their financial goals. The 2020 Workplace Benefits Report from Bank of America says that 41% of employees think getting advice from a financial planner would be one of the most important things an employer can offer. (3)

It makes sense for companies to leverage the investments they are already making in the form of retirement plans and help employees better understand their individual financial needs. Helping employees better understand the financial decisions they make will benefit the employees and the company.

As an example, an employee may understand the importance of contributing to a 401(k) plan for retirement, but they may not fully be aware of the potential negative impact borrowing from that plan to meet short-term emergency expenses may have on their retirement.

Since many employees do take out 401(k) loans to meet emergency needs, (4) companies, through a financial wellness program, can help their employees make educated decisions on whether taking that loan really is the best option. This benefits the employee, but it is also beneficial to the employer, because it could help relieve the employee’s financial stress and build employee loyalty toward the company.

So what do we mean when we talk about financial wellness? Financial wellness is a comprehensive approach to an individual’s financial situation, and this approach goes deeper than just focusing on retirement planning.

It delves into all of the aspects of an individual’s financial life including budgeting, long-term and short-term goal funding, retirement and all of the other pieces that make up an individual’s financial situation. It is helping people understand as much about their financial health as possible so they can make smart financial decisions they will benefit from in the short-term and the long-term.

Creating the plan is just the beginning. As part of the comprehensive approach, the overall goal is to empower individuals so they understand the mechanics of and have the knowledge and understanding to then implement that plan.

Authored by: Dennis Culver, Insight Wealth Strategies

- http://www.apa.org/news/press/releases/stress/2013/stress-report.pdf

- http://files.consumerfinance.gov/f/201408_cfpb_report_financial-wellness-at-work.pdf

- https://www.bofaml.com/content/dam/flagship/institutional-retirement/id20_0902/documents/2020WorkplaceBenefitReport_SinglePage_FINAL_9.16.20.pdf

- http://www.nytimes.com/2013/02/12/business/early-withdrawals-plague-retirement-accounts-study-says.html?_r=0