Navigating Medicare: What You Need to Know

Table of Contents

If you’re approaching age 65—or helping a loved one who is—then you’re probably hearing a lot about Medicare. For something that’s supposed to make life easier in retirement, it can feel incredibly confusing at first.

Health care is one of the biggest expenses in retirement. According to Fidelity, a 65-year-old individual can expect to spend an average of $165,000 to cover health costs during retirement—not including long-term care1.

This article will walk you through what Medicare is, what each part covers, and how to avoid common mistakes.

The Four Parts of Medicare: A, B, C, and D

Medicare isn’t just one program—it’s made up of several parts. Each one covers different aspects of your health care.

Part A: Hospital Insurance

Think of Part A as your coverage for big-ticket items like hospital stays.

It covers:

- Inpatient hospital care

- Short-term care in a skilled nursing facility

- Hospice services

- Some home health care

For most people, Part A is premium-free—you’ve already paid into it through payroll taxes during your working years. But it’s not 100% free of cost. For example, in 2025 there’s a $1,676 deductible if you go into the hospital2, and after 60 days, daily coinsurance applies.

Part B: Medical Insurance

Part B is what covers most of your day-to-day health needs.

It includes:

- Doctor visits

- Outpatient care (like same-day surgery)

- Lab tests and X-rays

- Preventive screenings

- Durable medical equipment

You’ll pay a monthly premium for Part B. In 2025, that standard premium is $185.00 per month, though it could be more if your income is above certain thresholds (we’ll cover that shortly).

There’s also a $257 deductible, and after that, Medicare pays 80%, and you’re responsible for the other 20%2.

What to watch for: If you delay signing up for Part B and don’t have other qualifying health coverage (like from a large employer), you could be hit with a permanent late enrollment penalty.

Part C: Medicare Advantage Plans

This is where things get more customizable.

Part C, or Medicare Advantage, is an alternative to Original Medicare (Parts A and B). These plans are offered by private insurance companies and usually include:

- All the coverage from Parts A and B

- Prescription drug coverage (Part D)

- Extra benefits like dental, vision, hearing, gym memberships, and telehealth

The catch? Most of these plans have networks—just like an HMO or PPO—so you’ll need to use in-network providers for full coverage. Additionally, should you enroll in Medicare Advantage and then later decide to move back to the traditional Part B Plan with a supplemental Medigap policy, you may be required to go through medical underwriting and may be denied access to a Medigap Plan if you have certain health conditions. We recommend you consult Medicare.gov for more specifics.

Part D: Prescription Drug Coverage

Part D covers your medications, and it’s provided through private plans.

You can get a stand-alone drug plan if you’re on Original Medicare, or you might have drug coverage bundled into your Medicare Advantage plan.

Key costs include:

- A monthly premium

- An annual deductible (up to $590 in 20253)

- Copayments or coinsurance for your prescriptions

What to watch for: Even if you don’t take medications now, not enrolling in Part D when you’re first eligible could result in a lifetime late penalty.

Medigap (Medicare Supplement Insurance)

If you go with Original Medicare (Parts A and B), you’ll still have some out-of-pocket costs like deductibles and 20% coinsurance. That’s where Medigap plans come in.

These are private insurance policies that help “fill in the gaps” left by Medicare. The most popular ones are:

- Plan G: Covers everything except the Part B deductible

- Plan N: Slightly lower premiums, with small copays

You have a six-month window starting when you enroll in Part B to buy a Medigap plan without answering health questions. After that, you may be denied or charged more based on your health.

Enrollment Timelines (and Why They Matter)

Here’s a quick overview of when to enroll:

- Initial Enrollment Period (IEP): This is the 7-month window around your 65th birthday (3 months before, the month of, and 3 months after). Most people should enroll in Parts A and B during this time.

- General Enrollment Period (GEP): January 1 to March 31 each year. This is a fallback if you missed your initial enrollment—but you may face penalties.

- Annual Enrollment Period (AEP): October 15 to December 7. This is when you can switch between Advantage plans, drug plans, or go back to Original Medicare.

- Medicare Advantage Open Enrollment: January 1 to March 31. Allows you to change from one Advantage plan to another or go back to Original Medicare.

Income-Related Costs (IRMAA)

If you’re in a higher income bracket, you might pay more for Part B and Part D due to something called IRMAA—the Income-Related Monthly Adjustment Amount.

This is based on your income from two years ago, so your 2025 premiums will be based on your 2023 tax return.

For example:

- If your income was $110,000 (individual), your Part B premium might jump to around $249/month instead of $179.80.

- Part D premiums can also increase by $12 to $76 depending on your income.

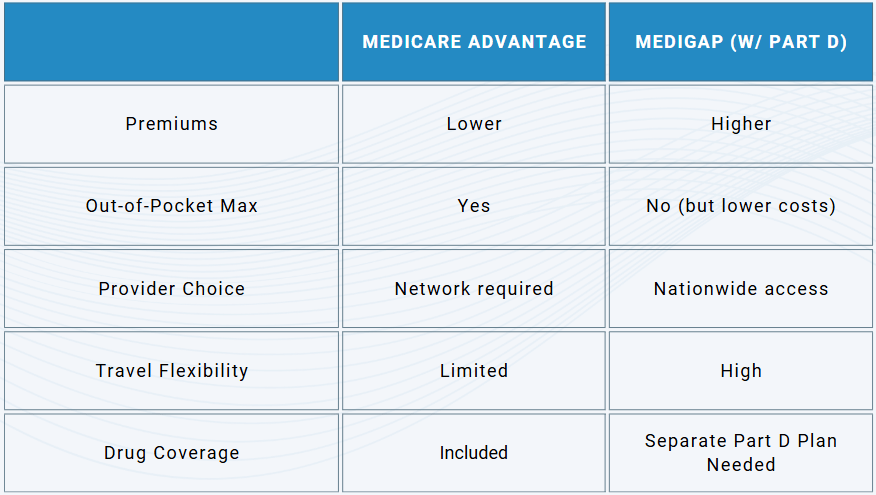

Medicare Advantage or Medigap?

The answer depends on your lifestyle, health needs, and budget.

If you like simplicity and don’t mind sticking with a network, Medicare Advantage might work well. If you want flexibility, especially for travel or complex health needs, Medigap often provides better peace of mind.

Make Medicare Work for You

Medicare is a critical piece of your retirement puzzle. Understanding your coverage options, avoiding costly penalties, managing premiums and income-related surcharges, and choosing plans that fit your health, lifestyle, and budget will help set you up for successful retirement living. Whether you’re retiring at 65, working a little longer, or just trying to get ahead of the game, you can make Medicare fit seamlessly into your overall financial plan.

Written by,

Tim Raftis, CFP®

Tim Raftis is a comprehensive, fee-only financial planner with Insight Wealth Strategies. With over 30 years in the financial services industry, Tim draws on his extensive experience to offer clients customized solutions to managing their wealth.

Tim is a problem solver who works to simplify clients’ financial lives. He assists clients in identifying and prioritizing their various goals – including investments, tax planning, retirement income, and wealth transfer – then develops strategies customized to suit their personal circumstances and their own unique feelings and attitudes.

Sources:

- https://newsroom.fidelity.com/pressreleases/fidelity-investments–releases-2024-retiree-health-care-cost-estimate-as-americans-seek-clarity-arou/s/7322cc17-0b90-46c4-ba49-38d6e91c3961

- https://www.ncoa.org/article/what-is-the-medicare-deductible/

- https://www.medicare.gov/health-drug-plans/part-d/basics/costs

Insight Wealth Strategies, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Insight Wealth Strategies, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Insight Wealth Strategies, LLC unless a client service agreement is in place.

Insight Wealth Strategies, LLC (IWS) and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.