Navigating the IRMAA Landscape

Understanding the intricacies of Medicare and its associated costs is crucial for effective financial planning. One key component is the Income-Related Monthly Adjusted Amount (IRMAA). In 2024, significant changes to IRMAA will impact Medicare Part B and Part D premiums, affecting individuals with incomes ranging from $103,000 to $397,000 and beyond.

What is IRMAA?

IRMAA, or Income-Related Monthly Adjusted Amount, is a Medicare premium surcharge that was introduced to ensure a fair distribution of healthcare costs among beneficiaries. Individuals with higher incomes contribute more in Medicare Part B (medical insurance) and Part D (prescription drug coverage) premiums. The premise behind IRMAA is to maintain the financial sustainability of the Medicare program by requiring those with greater means to bear a larger share of associated expenses. It is essential for individuals approaching retirement or already enrolled in Medicare to understand IRMAA, as it plays a crucial role in their overall healthcare costs during retirement.

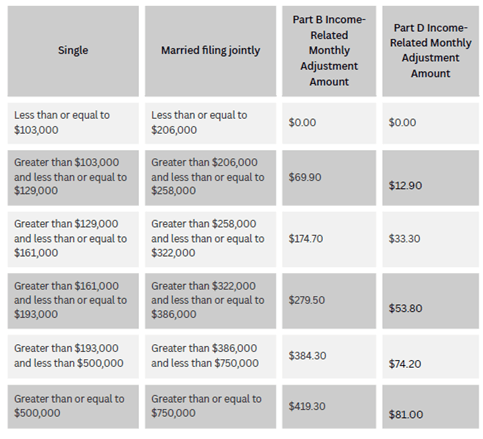

In 2024, the IRMAA structure is modified as follows:

- For incomes greater than $103,000 and less than $397,000, the IRMAA premium for Medicare Part B is $384.30.

- If income is greater than or equal to $397,000, the IRMAA expense increases to $419.30 for Medicare Part B.

For Medicare Part D:

- Incomes between $103,000 and $397,000 will incur an IRMAA cost of $74.20.

- If income is greater than or equal to $397,000, the IRMAA premium for Medicare Part D rises to $81.00.

IRMAA for 2024

Implications for Financial Planning Clients

People who fall within these income brackets should be aware of the potential impact on their Medicare costs, as it goes beyond just the immediate increase in premiums. The higher IRMAA amounts for Medicare Part B and Part D could have ripple effects on their overall retirement budget, potentially impacting the allocation of resources for other essential needs. Additionally, financial planners must consider the long-term implications of increased healthcare costs when crafting retirement income strategies, ensuring that clients’ financial plans remain resilient in the face of evolving healthcare expenses. This highlights the importance of a comprehensive financial plan that accounts for both the expected and unexpected costs associated with healthcare in retirement.

Potential Challenges and Considerations

People navigating these changes may face challenges tied to varying income levels. The adjustments in IRMAA could potentially impact their overall financial well-being, requiring a thoughtful evaluation of their unique circumstances. Those with incomes bordering the thresholds may need to carefully assess how these changes align with their broader financial goals. It is imperative to proactively engage with financial planners, exploring personalized strategies that not only mitigate the immediate impact but also align with long-term financial aspirations. The challenge lies in striking a balance that ensures continued financial security while adapting to the evolving healthcare cost landscape.

Planning Strategies

To proactively manage and minimize the impact of IRMAA, individuals should consider implementing the following strategies:

- Income Optimization: Evaluate your income sources and explore opportunities to optimize your taxable income. This may involve strategically timing withdrawals from retirement accounts, considering tax-efficient investment strategies, and exploring opportunities for income deferral.

- Roth Conversions: Explore the benefits of Roth IRA conversions. Converting traditional IRA funds to Roth IRAs can reduce future taxable income, potentially placing you in a lower IRMAA bracket. However, it’s crucial to carefully assess the tax implications of such conversions with a tax professional.

- Qualified Charitable Distributions (QCDs): Utilize Qualified Charitable Distributions (QCDs) from your IRA for charitable giving. By directing funds directly from your IRA to qualified charities, you can fulfill your charitable goals while reducing your taxable income, potentially helping to minimize your IRMAA costs.

- Health Savings Accounts (HSAs): If eligible, consider maximizing contributions to a Health Savings Account (HSA). Contributions to HSAs are tax-deductible, and withdrawals for qualified medical expenses are tax-free. Utilizing HSAs for medical expenses can help manage taxable income and potentially mitigate the impact of IRMAA premiums.

- Delaying Social Security: Delaying the start of your Social Security benefits could also be a strategic move. By delaying, you not only increase your eventual benefit amount, but you may also reduce your taxable income in the short term, potentially impacting your IRMAA bracket.

- Tax Planning and Professional Advice: Engage with a tax professional or financial advisor to develop a comprehensive tax planning strategy. They can help you navigate the complexities of your individual financial situation, ensuring that your plan aligns with both your short-term and long-term goals.

Implementing a combination of these strategies tailored to your specific circumstances can contribute to a more tax-efficient and financially sound retirement, minimizing the impact of IRMAA expenses on your overall financial plan.

In conclusion, navigating the evolving landscape of IRMAA in 2024 requires a proactive and personalized approach to financial planning. The changes in income thresholds for Medicare Part B and Part D premiums remind us of the importance of strategic planning to minimize the impact on your overall retirement budget. As you consider the various strategies outlined above, it’s crucial to align them with your unique financial goals and circumstances.

At Insight Wealth Strategies, we understand the intricacies of retirement planning, including the complexities introduced by IRMAA. Our experienced advisors are here to guide you through these changes, offering tailored strategies that align with your long-term financial aspirations. Your financial security is our priority, and we invite you to reach out to our team for an initial consultation. Whether you’re a current client or seeking professional advice for the first time, we are dedicated to helping you navigate the complexities of retirement planning with confidence. Contact us today to take the first step towards a secure and well-planned financial future.

Reviewed by,

Brian Stormont, CFP®

Brian Stormont is a comprehensive, fee-only financial advisor with Insight Wealth Strategies who began his career in the financial industry in 2000. His expertise encompasses retirement planning, investment planning, estate planning, and high-level strategies to help business owners and individuals minimize their income taxes.

Insight Wealth Strategies, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Insight Wealth Strategies, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Insight Wealth Strategies, LLC unless a client service agreement is in place.

Insight Wealth Strategies, LLC (IWS) and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.