Retirement Planning for Women:

Take Control of Your Financial Future

Table of Contents

Retirement planning can be uniquely challenging for women due to several financial and lifestyle factors. On average, women live longer than men, meaning they must stretch their retirement savings over more years. Additionally, career interruptions—whether for caregiving or family responsibilities—can lead to lower lifetime earnings and reduced Social Security benefits. Women are also more likely to take on part-time roles with fewer retirement benefits, meaning they need to maximize savings opportunities. Despite these challenges, proactive planning and strategic investing can help women build financial security and confidence for retirement.

Why Retirement Planning is Different for Women

Women face unique financial challenges that can require a tailored approach to retirement planning. Longer life expectancy means women must ensure their savings last for a potentially extended retirement. Career gaps, often due to caregiving responsibilities, result in lower lifetime earnings and reduced Social Security benefits, making it harder to build wealth. Some studies suggest that women’s investment tendencies often lean toward lower-risk options and can limit growth potential1. Addressing these challenges needs strategic planning, smart investment choices, and proactive wealth management to help secure long-term financial stability.

Longer Life Expectancy Requires More Savings

Women typically live longer than men, which means they need to save more to fund additional years in retirement. On average a woman who retires at 67 will live another 20 years, which is over 2 years longer than their male counterparts1. This extended lifespan increases the risk of outliving savings. Longevity often also brings higher healthcare expenses, including rising costs for long-term care services like assisted living or nursing home care.

Strategies to Address This Challenge:

- Plan for Longevity: Assume a longer retirement horizon when estimating savings needs.

- Consider Long-Term Care Insurance: Protect against the high costs of assisted living or nursing care.

- Maximize Tax-Advantaged Savings: Utilize retirement accounts like IRAs and 401(k)s to grow savings efficiently.

Career Gaps and Lower Lifetime Earnings

Many women take breaks from the workforce to care for children or aging parents, which directly impacts their retirement savings. Fewer working years mean lower lifetime earnings, reduced employer-sponsored retirement contributions, and smaller Social Security benefits. As a result, women may enter retirement with less financial security than men.

Strategies to Address This Challenge:

- Catch-Up Contributions: Women over 50 can contribute extra to 401(k)s and IRAs to make up for lost savings time.

- Leverage Spousal Benefits: If married, women can claim Social Security spousal benefits, which may provide higher payouts.

- Prioritize Retirement Savings: Even during caregiving years, making small, consistent contributions can significantly impact long-term financial security.

Unique Investment and Risk Considerations

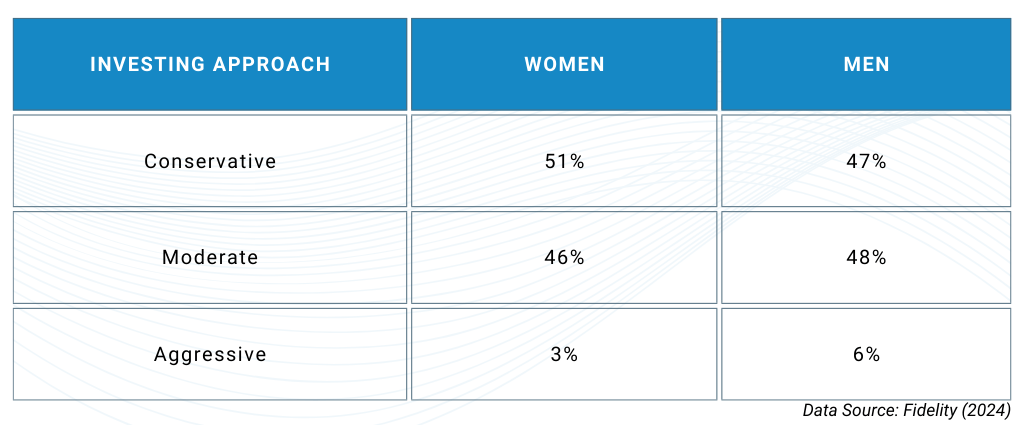

Women tend to be more conservative investors, often prioritizing safety over growth. While caution can help protect savings, being overly risk-averse may lead to lower returns, making it harder to keep pace with inflation and sustain a long retirement.

Strategies to Address This Challenge:

- Adopt a Balanced Investment Approach: A mix of stocks, bonds, and other assets can help optimize risk and return.

- Work with a Financial Advisor: Professional guidance can help tailor investment strategies to long-term goals.

- Stay Invested for Growth: Keeping a portion of assets in growth-oriented investments ensures purchasing power over time.

Key Steps to Secure Your Retirement

Taking control of your retirement planning starts with proactive, strategic steps that maximize savings, optimize investments, and prepare for future expenses. Women face unique financial hurdles, but by following these key strategies, they can build a solid foundation for long-term security and financial independence.

Start Saving Early and Maximize Contributions

The earlier you start saving for retirement, the more you can benefit from the power of compound interest. Even small contributions made consistently over time can grow significantly. Women should take full advantage of tax-advantaged retirement accounts to accelerate their savings.

Ways to Maximize Retirement Contributions:

- Utilize Employer-Sponsored Plans: Contribute to a 401(k), especially if your employer offers a matching contribution—this is essentially free money.

- Open an IRA: Choose between a Traditional IRA (tax-deductible contributions) or a Roth IRA (tax-free withdrawals in retirement).

- Catch-Up Contributions: If you’re 50 or older, take advantage of extra contribution limits to boost your savings.

- Automate Savings: Setting up automatic contributions ensures consistency and prevents the temptation to spend.

Diversify Investments for Long-Term Growth

A well-diversified portfolio is key to balancing risk and return, helping women protect their savings while still growing their wealth. Investing in a mix of asset classes—stocks, bonds, and alternative investments—can provide stability and long-term financial security.

Investment Strategies for Women:

- Asset Allocation Matters: Younger investors can allocate more to stocks for growth, while those nearing retirement should shift toward bonds and stable investments.

- Rebalance Regularly: Adjust investments over time to align with changing risk tolerance and financial goals.

- Consider Professional Guidance: A financial advisor can help create a personalized investment strategy based on individual needs.

Plan for Healthcare and Long-Term Care Costs

Healthcare is one of the biggest expenses in retirement, and women—who tend to live longer—need to prepare for the rising costs of medical care and long-term care services. Without proper planning, these expenses can quickly erode savings.

Strategies to Cover Healthcare Costs:

- Health Savings Accounts (HSAs): If you have a high-deductible health plan, contribute to an HSA, which offers tax-free growth and withdrawals for medical expenses.

- Long-Term Care Insurance: Consider purchasing a policy early to lock in lower premiums and cover the cost of assisted living or nursing home care.

- Medicaid Planning: Understanding Medicaid eligibility and planning ahead can help cover long-term care costs without depleting personal assets.

How to Close the Retirement Savings Gap

If you’re behind on retirement savings, don’t panic—there are still ways to strengthen your financial future. By taking these steps now, you can help boost your savings, maximize income sources, and work towards a more secure retirement.

Take Advantage of Catch-Up Contributions

For women over 50, catch-up contributions provide an excellent way to accelerate retirement savings. These higher contribution limits allow individuals to put more into tax-advantaged retirement accounts, helping to make up for lost time.

Key Catch-Up Strategies:

- 401(k) Contributions: In 2025, individuals over 50 can contribute an additional $7,500 beyond the standard $23,500 limit2.

- IRA Contributions: Those over 50 can contribute an extra $1,000 annually to Traditional or Roth IRAs2.

- Delay Social Security: Waiting to claim Social Security benefits beyond full retirement age (up to age 70) can significantly increase monthly payouts, providing higher guaranteed income later in life.

Explore Additional Income Streams

Creating new income sources can help women bridge retirement savings gaps and reduce reliance on savings alone. Whether through active or passive income strategies, additional earnings can make a significant difference.

Ways to Generate Extra Retirement Income:

- Start a Side Business: Leverage skills or hobbies into freelance work, consulting, or an online business.

- Consider Rental Income: Owning rental property or short-term rentals can provide a steady income stream.

- Invest in Passive Income Assets: Dividend-paying stocks, bonds, and annuities can generate regular cash flow.

- Monetize Expertise: Teaching, coaching, or tutoring in a specialized field can provide supplemental income with flexible hours.

Work with a Financial Advisor

Navigating retirement planning alone can be overwhelming, especially when trying to close a savings gap. A financial advisor can provide personalized strategies to optimize savings, investments, and withdrawal plans.

How a Financial Advisor Can Help:

- Assess Your Current Plan: Identify gaps and create a tailored strategy to boost retirement readiness.

- Optimize Investments: Ensure your portfolio is structured for long-term growth while managing risk.

- Plan Withdrawals Efficiently: Develop a tax-efficient withdrawal strategy to make savings last longer.

- Adjust Plans Over Time: Regular financial check-ins help adapt to changing circumstances and goals.

Secure Your Financial Future with Insight

Retirement planning isn’t just about saving money—it’s about securing financial independence, peace of mind, and the ability to enjoy the life you’ve worked hard to build. Women face unique financial challenges, but with proactive planning and smart investment strategies, they can overcome these hurdles and create a secure future. The key is to take action now.

At Insight Wealth Strategies, we understand that every woman’s financial journey is different. Whether you’re just starting to plan for retirement, catching up on savings, or refining your investment strategy, our team is here to help. We provide personalized financial planning to ensure your retirement plan aligns with your goals, risk tolerance, and long-term needs.

Take Control of Your Retirement Today

Don’t wait to secure your financial future—start planning now. With the right strategy, you can maximize your savings, grow your investments, and prepare for the future with confidence.

Contact Insight Wealth Strategies, LLC today to schedule a consultation and take the first step toward a stronger, more secure retirement.

Reviewed by,

Chad Seegers, CRPC®

Chad began his career with Sagemark Consulting in 2005 and then became a Select member of Sagemark’s Private Wealth Services which operated as a national resource for financial planners focusing on Advanced Strategies in the High Net Worth marketplace. Chad then began his partnership with Insight Wealth Strategies in 2013 focused on retirement planning primarily with Oil and Gas employees and executives. His primary areas of expertise are retirement, estate, and investment strategies as he serves as Investment Strategist for the financial planning team.

More Retirement Planning Resources Here

Sources:

- https://www.dol.gov/agencies/ebsa/about-ebsa/our-activities/resource-center/publications/women-and-retirement-savings

- https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000

Insight Wealth Strategies, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Insight Wealth Strategies, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Insight Wealth Strategies, LLC unless a client service agreement is in place.

Insight Wealth Strategies, LLC (IWS) and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.