Retiring During a Volatile Market

Retiring during a period of high market volatility can be scary. This is exactly the situation many recent retirees are facing now as the stock and bond markets respond to high inflation, rising interest rates, Fed tightening, and the Russia/Ukraine war. At the time of this writing, the S&P 500 is currently down a staggering -16.63% year-to-date. Similarly, the U.S. Aggregate Bond Index is down an unprecedented 9.10% year-to-date. What does this spell for an individual who wants to retire tomorrow?

While there are always risks when preparing for retirement, there is one that does not get explained very often: sequence of returns risk. We know that historically, the markets have constantly shifted back and forth between periods of steady growth and periods of correction. Essentially, the concept of sequence of returns risk is this: for an investor taking distributions from their retirement portfolio, the order in which these dueling periods of growth and decline occur can make a substantial difference in your portfolio’s outcome.

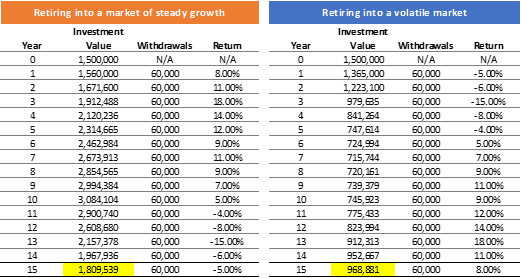

Let’s look at an example of sequence of returns risk by looking at the following scenarios:

In both scenarios, we are looking at a retiree with a $1.5M investment portfolio at retirement taking $60,000 per year in distributions. The table shows that despite averaging the same 4% return over a 15-year retirement period, the individual retiring into a volatile market has $840,658 less than if he had retired into the steady growth market scenario with the sequence of returns reversed.

While we aren’t suggesting an individual delay their planned retirement during a time of uncertainty, having knowledge of how sequence of returns risks can impact a portfolio over a long-term retirement can help the investor make informed decisions when creating a retirement income strategy.

There are different ways to manage sequence of returns risk. These include monitoring your retirement withdrawal rate, strategically utilizing equity in other assets, or setting up a cash reserve bucketing strategy. If you have recently retired or are planning to retire in the current volatile market, having a financial advisor who understands how to mitigate sequence of returns risk can provide you with guidance and clarity over your retirement income strategy. From Houston retirement planning to San Ramon retirement planning, our team takes all aspects of your life into account.

Written by:

Paolo Coronel

Paolo joined Insight Wealth Strategies in 2019 and works as an Associate Advisor on our Advisory team creating financial plans and implementing investment management strategies for our clients. He holds a Bachelor’s degree in Finance from California Baptist University and has previously passed his Series 7 and 66 licenses as well as his CA life, health and variable insurance.

Want to read more articles by Paolo?

Sources:

https://www.forbes.com/advisor/retirement/sequence-of-returns-risk/

Insight Wealth Strategies, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Insight Wealth Strategies, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Insight Wealth Strategies, LLC unless a client service agreement is in place.

Insight Wealth Strategies, LLC (IWS) and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.