Understanding Sequence of Returns Risk in

Retirement Planning

Table of Contents

When it comes to retirement, how much you’ve saved is only part of the equation—when you experience market gains and losses can be just as important. This is where sequence of returns risk comes into play. Poor investment returns early in retirement—when you’ve just started withdrawing from your portfolio—can significantly shorten the lifespan of your savings. Protecting your investments from sequence risk becomes crucial for sustainable income. Even a well-funded retirement plan can be thrown off course if market downturns align with early withdrawal years. The right approach reduces your risk of running out of money in retirement. Understanding this risk is important for retirees who want a sustainable income stream that lasts.

What is Sequence of Returns Risk and Its Impact?

Sequence of returns risk refers to the impact that the order of investment returns has on a financial portfolio—especially when withdrawals are occurring. Sequence risk emphasizes that even if the market provides substantial long-term gains, negative sequences early in retirement can greatly affect your future financial stability. While long-term average returns might look favorable, the sequence in which gains and losses occur can lead to very different outcomes. This phenomenon highlights the necessity of strategic financial planning services to safeguard retirement assets.

Unlike those still accumulating wealth, retirees need to take income from their assets even during down markets. Early withdrawals combined with losses can quickly reduce portfolio value, leaving less principal to recover when the market rebounds. For many, this raises the question: is wealth management worth it? Effective wealth management can help navigate these challenges by optimizing withdrawal strategies and preserving assets for the long term.

This risk is especially important for retirees who depend on investments for income. Even portfolios with solid long-term performance can fall short if the return order is unfavorable.

Why It’s a Major Concern for Retirees

Withdrawals magnify the impact of early financial losses. When a portfolio drops in value and you’re drawing income at the same time, you’re forced to sell assets at lower prices, leading to negative impacts on growth potential. This approach helps to protect the long-term security of your retirement funds.

This creates a compounding effect: as the portfolio shrinks, it becomes harder for it to recover—even if the market performs well later. The early years of retirement are a critical window, and protecting your money during this time can greatly influence how long your money lasts.

Real-Life Examples and Case Studies

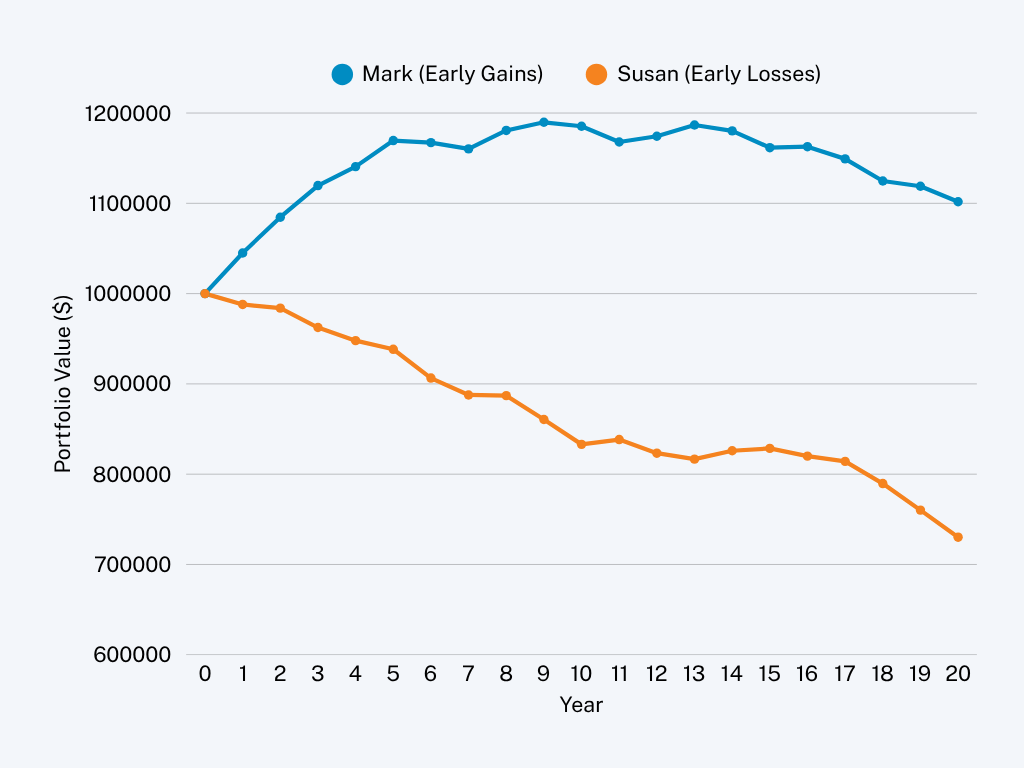

Let’s look at two hypothetical retirees—Mark and Susan—each retiring with $1 million and withdrawing $50,000 annually. Both experience the same average return over 20 years, but the sequence is different.

- Mark sees strong market performance early in retirement, giving his portfolio a cushion before any downturns.

- Susan retires into a market decline, and early withdrawals during those down years erode her portfolio quickly.

This visual demonstrates how timing—not just average return—can dramatically affect retirement outcomes. It’s a real risk that deserves serious attention in your planning.

Strategies to Reduce Sequence of Returns Risk and Its Impact

Effectively managing this risk requires more than a diversified portfolio. It involves using flexible strategies to adapt to market variability. Here are three practical strategies:

Diversify Income Sources

Depending solely on investment withdrawals adds pressure during market dips. Maintaining a balance between guaranteed income and market investments can reduce risk. Incorporate multiple income streams, such as pensions, annuities, or even part-time work—to reduce reliance on portfolio draws. Incorporating guaranteed income streams like annuities reduces dependence on market returns. Saving more money in different investment buckets can also help manage risks. Allocating between stock, bond, and cash investments adds protection and flexibility. These sources can help cover essential expenses in tough years, preserving your investments for the long term.

Maintain a Cash Reserve

A cash reserve can serve as a buffer during downturns. Having one to two years’ worth of living expenses in a liquid account allows you to avoid withdrawing from investments when markets are down. This protective measure secures funds against immediate market fluctuations and gives your portfolio breathing room to recover and supports a more stable income strategy. High-yield accounts allow your cash reserve to earn interest while remaining accessible.

Flexible Withdrawal Strategies

Rigid withdrawal plans—like withdrawing a fixed amount annually—can accelerate portfolio depletion if markets fall early. This could be especially beneficial early in retirement years when the sequence risk may offer a better approach. Dynamic strategies help mitigate sequence risk and may offer a better approach. Adjusting your withdrawal rate annually helps avoid unnecessary risk during poor market years.

Methods like the Guyton-Klinger rules or simple percentage-based withdrawals adjust your income based on portfolio performance. This adaptability provides benefits by helping you preserve your savings and adds resilience in volatile markets.

Role of a Financial Advisor in Managing This Risk

Managing sequence of returns risk isn’t about reacting to market swings—it’s about proactive, personalized planning. A financial advisor can help you build a strategy that accounts for timing, income needs, and changing market conditions. Financial advisors can help you minimize sequence risk through strategic planning.

Advisors model return scenarios, structure withdrawals strategically, and offer advice as circumstances evolve. They provide guidance in implementing income diversification, maintain a reserve fund, and advise you in choosing a flexible withdrawal strategy that fits your risk tolerance.

Ongoing oversight—like portfolio rebalancing and annual reviews—can make all the difference in protecting your retirement income over time.

Conclusion

Sequence of returns risk is one of the most important yet often overlooked aspects of financial planning for retirement. Even with sufficient savings, poor timing can put long-term income at risk. The right planning leads to stronger retirement results, even in volatile markets.

By planning ahead with strategies like income diversification, cash reserves, and dynamic withdrawals, you can build a retirement plan designed to weather market uncertainty.

If you’re nearing or already in retirement, now is the time to make sure your strategy accounts for this risk. Smart planning today protects your future retirement income—giving you more control, stability, and peace of mind. Connect with an advisor at Insight Wealth Strategies to review your plan and explore ways to strengthen your retirement income—so you can retire with greater confidence and peace of mind.

Reviewed by,

Chad Seegers, CRPC®

Chad began his career with Sagemark Consulting in 2005 and then became a Select member of Sagemark’s Private Wealth Services which operated as a national resource for financial planners focusing on Advanced Strategies in the High Net Worth marketplace. Chad then began his partnership with Insight Wealth Strategies in 2013 focused on retirement planning primarily with Oil and Gas employees and executives. His primary areas of expertise are retirement, estate, and investment strategies as he serves as Investment Strategist for the financial planning team.

Insight Wealth Strategies, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Insight Wealth Strategies, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Insight Wealth Strategies, LLC unless a client service agreement is in place.

Insight Wealth Strategies, LLC (IWS) and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.