Top Strategies for Navigating Forced Retirement

Table of Contents

Forced retirement can be an overwhelming experience, bringing feelings of uncertainty about your financial future. However, with the right strategies, it’s possible to navigate this life change and emerge financially stronger. By setting clear financial goals, reevaluating your priorities, and preparing for the future, you can transition smoothly into retirement while maintaining long-term financial stability. Whether you’re facing this challenge unexpectedly or had some time to prepare, these strategies can help you take control of your financial future and embrace this new chapter with confidence.

Understanding Forced Retirement

What Is Forced Retirement?

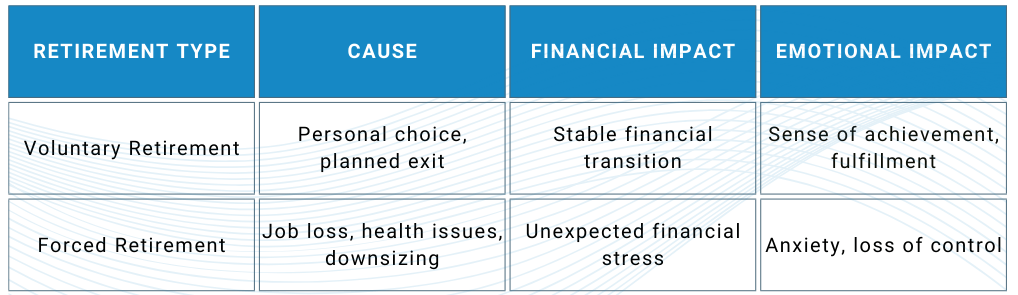

Forced retirement occurs when employees leave the workforce earlier than planned due to circumstances beyond their control. This can arise from corporate downsizing, restructuring, or mergers where positions are eliminated. Health issues, either personal or involving a family member, can also lead to an early and unexpected exit from the workforce. In some cases, changes in industry demand, automation, or technological advancements can make certain roles obsolete, leaving employees with no choice but to retire earlier than anticipated. Regardless of the cause, forced retirement can disrupt long-term plans and require swift financial and lifestyle adjustments.

Is Forced Retirement Age Discrimination?

Forced retirement can sometimes raise questions about age discrimination. The Age Discrimination in Employment Act of 1967 (ADEA) protects workers aged 40 and older from discriminatory practices based on age in hiring, promotion, and termination decisions1. While mandatory retirement policies are generally prohibited, there are exceptions for certain roles, such as executives in high policy-making positions or jobs requiring physical capabilities, like pilots.

If you suspect that your forced retirement stems from age discrimination, it’s crucial to understand your rights under the ADEA and consult with an employment attorney or human resources expert. Documenting your experiences and understanding your legal options can help you seek justice if unfair practices are at play.

Emotional and Financial Coping Strategies

How to Cope with Forced Retirement

Forced retirement is a significant life change that can bring a mix of emotions, from anxiety to frustration or even relief. It’s important to give yourself time to process these feelings and recognize that you are not alone—many people face similar challenges and successfully adapt.

Avoid rushing into major decisions during this time of transition. Instead, focus on gaining clarity by organizing your finances and exploring your options. Seek support from trusted friends, family, or a financial advisor to help you navigate this period with confidence. Taking small, deliberate steps can make this overwhelming situation feel more manageable.

Taking Control of Your Finances

The first step in regaining a sense of stability is to assess your financial situation. Start by reviewing your savings, retirement accounts, and any severance package you may have received. Understanding the resources you have available will give you a clearer picture of your financial foundation.

Next, create a list of your monthly expenses and identify areas where you can cut back if needed. Reducing discretionary spending, like dining out or entertainment, can help stretch your budget during this transition. By proactively managing your finances, you’ll set the stage for long-term stability and make it easier to adjust to your new circumstances.

Practical Strategies for Managing Forced Retirement

Exploring Alternative Income Streams

Forced retirement doesn’t have to mean the end of earning opportunities. Many retirees explore part-time work, freelancing, or consulting in their areas of expertise to supplement their income. These job options not only provide financial benefits but can also add structure and a sense of purpose to your days. Consider leveraging your professional network or online platforms to explore retirement income strategies and find job opportunities that align with your skills and interests.

Adjusting Your Lifestyle

Adjusting to a new financial reality may require lifestyle changes to ensure your long-term stability. Start by evaluating your expenses and identifying areas to reduce costs. Downsizing your home, eliminating non-essential subscriptions, or switching to more budget-friendly alternatives for regular expenses can make a significant impact. Aligning your spending with your revised income will help you maintain control over your finances and reduce stress.

Leveraging Community Resources

Many communities offer valuable resources to support individuals navigating forced retirement. Retirement workshops, support groups, and financial planning events can provide guidance, practical tools, and emotional support. Local libraries, senior centers, and non-profit organizations often host free or low-cost events to help you learn about financial management, healthcare options, and more. Engaging with these resources can help you build a supportive network and gain confidence in managing your retirement transition.

Strategic Financial Moves

Optimizing Social Security

One of the most important decisions during forced retirement is when and how to claim Social Security benefits. Waiting until full retirement age or even delaying benefits beyond that can result in significantly higher monthly payments over the long term. However, if you need income immediately, starting early may be the right move. Carefully evaluate your financial situation, life expectancy, and other income sources to determine the claiming strategy that maximizes your benefits. Consulting with a financial advisor can help you make an informed decision tailored to your needs.

Managing Retirement Accounts

Retirement accounts, such as 401(k)s and IRAs, can serve as vital resources during forced retirement. Take advantage of penalty-free withdrawals if you meet the age requirement, and consider Roth IRA conversions to reduce taxable income in the future. Strategic tax planning, such as timing withdrawals to avoid being pushed into a higher tax bracket, can help you stretch your retirement savings further.

If you’ve received a severance package from your employer, consult a financial advisor to determine the best way to allocate those funds, whether for immediate expenses, debt reduction, or investments. Proactive management of your retirement accounts can ensure long-term financial stability.

Is Forced Retirement Bad?

While forced retirement may feel daunting, it can also be an opportunity to embrace a new chapter in life. Reframe the situation by focusing on the possibilities ahead. Part-time work, freelance roles, or volunteering can provide fulfillment, maintain your sense of purpose, and even supplement your income.

This transition also offers a chance to prioritize personal goals that may have been sidelined during your career, such as being able to travel, pursuing hobbies, or spending more time with loved ones. Viewing forced retirement as a fresh start can help shift your mindset and bring positivity to this significant life change.

Creating a Resilient Retirement Plan

Building a resilient retirement plan is essential to navigating forced retirement and ensuring long-term financial stability. A goals-based plan tailored to your lifestyle aspirations provides a clear roadmap for managing your finances while aligning with your priorities. Whether you dream of traveling, pursuing hobbies, or supporting your family, a personalized plan can help you maintain your desired quality of life.

Collaborating with Insight Wealth Strategies can provide the guidance and expertise you need during this transition. As a fiduciary, Insight is committed to putting your best interests first, offering comprehensive retirement planning, tax strategies, and tailored advice designed to meet your unique needs.

From evaluating income sources to developing strategies for managing retirement accounts and reducing taxes, Insight’s financial advisors provide the tools and resources necessary to create a plan that adapts to life’s changes. With Insight by your side, you can confidently navigate forced retirement and focus on achieving your long-term goals.

Conclusion – Build a Strong Financial Future with Insight Wealth Strategies

Forced retirement, while unexpected, doesn’t have to disrupt your financial future. By taking proactive steps to manage your emotions, organize your finances, and create a resilient retirement plan, you can navigate this transition with confidence and stability.

At Insight Wealth Strategies, we understand the challenges of forced retirement and are here to help you turn this life change into an opportunity for growth. Our fiduciary approach ensures your best interests come first, while our comprehensive services—including retirement planning, tax strategies, and personalized financial advice—equip you with the tools to build a strong financial future.

Partner with Insight Wealth Strategies to take control of your retirement journey and achieve the peace of mind you deserve. Let’s work together to make your retirement a fulfilling and secure chapter of your life.

Reviewed by,

Brian Stormont, CFP®

Brian Stormont is a comprehensive, fee-only financial advisor with Insight Wealth Strategies who began his career in the financial industry in 2000. His expertise encompasses retirement planning, investment planning, estate planning, and high-level strategies to help business owners and individuals minimize their income taxes.

Retirement Planning Guidance & Tips

Sources:

Insight Wealth Strategies, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Insight Wealth Strategies, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Insight Wealth Strategies, LLC unless a client service agreement is in place.

Insight Wealth Strategies, LLC (IWS) and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.