Wills vs. Estate Plans: What Sets Them Apart?

Table of Contents

When it comes to securing your legacy, understanding the difference between a will and a comprehensive estate plan is essential. Both tools help manage and distribute your assets after death, but an estate plan offers a broader, more proactive approach. While a will outlines who receives what, an estate plan can address everything from healthcare directives and tax strategies to trusts and guardianship arrangements. Planning early not only reduces confusion and legal challenges but also helps support long-term financial goals for your family. At Insight Wealth Strategies, we guide clients through estate planning with care and precision—especially those facing complex family dynamics or significant wealth considerations.

What Is a Will?

Basic Definition and Purpose

A will is a legal document that outlines how a person’s assets should be distributed after their death. It serves as a clear set of instructions for how property, personal belongings, and other assets should be handled. A will also names an executor—the individual responsible for carrying out these instructions—as well as the beneficiaries who will receive the assets. For parents, a will can also designate guardianship for minor children, making it a critical part of protecting a family’s future.

When a Will Takes Effect

A will only becomes legally effective upon the death of the person who created it. At that point, the will must go through probate—a court-supervised legal process that validates the document and oversees the distribution of assets. Probate can be time-consuming and public as information in documents is processed, and it may involve court fees and delays, especially if the will is contested or unclear.

What Is an Estate Plan?

Comprehensive Asset Protection

An estate plan is a broader, more strategic financial planning approach to managing your assets and wishes. While it includes a will, it goes much further—encompassing legal, financial, and healthcare-related decisions. A complete estate plan checklist often includes trusts to manage and distribute assets, powers of attorney for financial and legal matters, and healthcare directives that outline your preferences for medical care if you’re unable to communicate. This layered approach helps make sure your wishes are respected both during your lifetime and after your death.

Benefits of Estate Planning

Estate plans offer several advantages over a simple will. They can help minimize estate taxes, avoid the probate process, and maintain privacy—as trusts and other tools can keep your affairs out of the public record. Importantly, estate planning also accounts for potential incapacity, giving you the ability to name trusted individuals to make financial and healthcare decisions on your behalf. This proactive planning can provide peace of mind and greater control over your legacy.

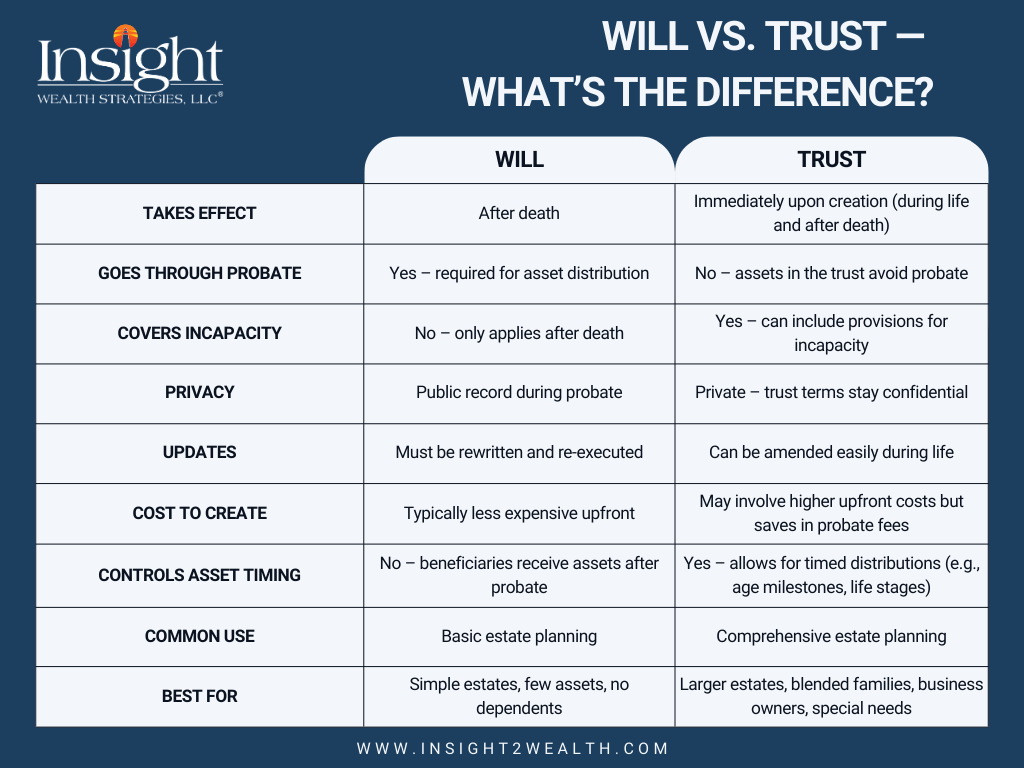

Wills vs. Estate Plans: What’s the Difference?

Scope and Detail

The primary difference between a will and an estate plan lies in their scope. A will is focused solely on the distribution of property after death. In contrast, an estate plan is much more comprehensive—it addresses not only asset distribution, but also long-term financial strategies, tax planning, healthcare decisions, and incapacity planning. Estate plans are designed to manage both life and legacy in a way that aligns with your overall goals.

Probate Implications

Wills must go through probate, a court-supervised process that can be time-consuming and public. This often leads to delays and added costs for loved ones. Estate plans, particularly those that include revocable living trusts, can bypass probate altogether. This allows for a smoother, faster transfer of assets while preserving your family’s privacy and reducing administrative burdens.

Timing and Flexibility

Wills are only effective after death, but estate plans can be active during your lifetime and continue after. Tools like powers of attorney and healthcare directives kick in if you’re incapacitated, while trusts can manage your assets immediately upon creation. Estate plans also offer greater flexibility, allowing for updates as your family situation, financial standing, or goals change over time.

Does an Estate Override a Will?

Clarifying Misconceptions

One common misunderstanding is that an “estate” can override a will—but in reality, an estate is simply the collection of a person’s assets at the time of their death. The estate doesn’t make decisions; it follows the legal instructions laid out in a valid will or, if none exists, state intestacy laws. However, not all assets are governed by a will. For example, jointly owned property, retirement accounts with named beneficiaries, and life insurance policies typically pass directly to the co-owner or designated beneficiary—regardless of what the will says. In these cases, the will has no legal control.

How Trusts Can Supersede a Will

Trusts, rather than wills, are tools within an estate plan that can operate independently of a will. When assets are placed into a properly funded trust, the trust document dictates how and when those assets are distributed. This means a trust can effectively supersede a will for the assets it holds. To ensure this works as intended, it’s crucial to fund the trust correctly—by retitling assets or naming the trust as the beneficiary. This approach gives you more control, privacy, and efficiency in managing your legacy.

Which Option Is Right for You?

When a Will Might Be Enough

A simple will may be sufficient if your financial situation is straightforward. If you have few assets, no dependents, and a clear plan for who should inherit your property, a will can effectively document your wishes. It’s also helpful to update your will, naming naming an executor and choosing a guardian if you have minor children. For individuals without complex financial or family dynamics, a basic will can provide a solid foundation.

Why Many People Benefit from an Estate Plan

However, if you have a blended family, own a business, or hold significant assets, a comprehensive estate plan may be the better choice. Estate plans provide greater control, help you plan for incapacity, and offer important protections against taxes, probate, and family disputes. They can be especially valuable estate planning tools for high-net-worth individuals or for those looking to preserve wealth across generations or manage assets with greater privacy and flexibility.

Build a Thoughtful Estate Strategy with Insight Wealth Strategies

Your estate decisions shouldn’t exist in a vacuum—they should align with your broader financial goals. At Insight Wealth Strategies, we believe in building estate plans that not only protect what you’ve built, but also support your long-term vision. While a will can address the basics, a comprehensive estate plan offers the flexibility and foresight needed to adapt as your life and finances evolve.

Find financial advisors in Houston and San Ramon to stay confident in your wealth management and retirement planning.

Ready to plan for the future with confidence? Contact Insight to create a personalized estate strategy that protects your assets and honors your wishes.

Reviewed by,

Chad Seegers, CRPC®

Chad began his career with Sagemark Consulting in 2005 and then became a Select member of Sagemark’s Private Wealth Services which operated as a national resource for financial planners focusing on Advanced Strategies in the High Net Worth marketplace. Chad then began his partnership with Insight Wealth Strategies in 2013 focused on retirement planning primarily with Oil and Gas employees and executives. His primary areas of expertise are retirement, estate, and investment strategies as he serves as Investment Strategist for the financial planning team.

Insight Wealth Strategies, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Insight Wealth Strategies, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Insight Wealth Strategies, LLC unless a client service agreement is in place.

Insight Wealth Strategies, LLC (IWS) and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.