Market Insights

Q1- 2023

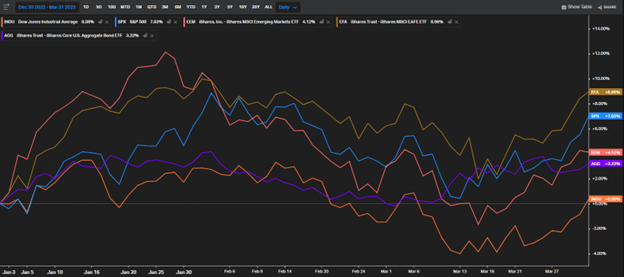

The S&P 500 ended the first quarter of 2023 with a solid gain. Hopes for an economic “soft landing” and the Fed signaling that their historic rate hike campaign is coming to an end, helped offset two rate increases and the biggest bank failures since the financial crisis.

Markets started 2023 with strong gains in January, which were primarily driven by a continued decline in widely followed inflation indicators. That decline in price pressures was coupled with surprisingly resilient economic data, especially in the labor market.

The final month of the first quarter began with investors still focused on inflation and potential interest rate hikes, but the sudden failure of Silicon Valley Bank, at the time the 16th largest bank in the United States, shifted investor focus to a potentially growing banking crisis. Signature Bank of New York failed just days later, and concerns about a regional banking crisis surged. In response, the Federal Reserve and the Treasury Department created new lending programs aimed at shoring up regional banks and preventing bank runs but concerns about the health of the financial system persisted and those fears weighed on markets through the middle of March. However, while the Federal Reserve hiked interest rates again at the March meeting, policy makers signaled that they are very close to ending the current rate hike campaign. That admission, combined with no additional large bank failures, eased concerns about a growing banking crisis, and the S&P 500 was able to rally during the final two weeks of March to finish off the month with a small gain.

In sum, markets were impressively resilient in the first quarter as a looming end to rate hikes, further declines in inflation and quick and effective actions by government officials in response to regional bank failures helped shore up confidence in the banking system. Stocks and bonds both logged modest gains in Q1, despite the threat of a regional banking crisis and still-elevated market volatility.

Internationally, foreign markets largely traded in line with the S&P 500 in the first quarter and realized positive returns. Foreign developed markets outperformed the S&P 500 through the first three months of the year as economic data in Europe was better than expected and European banks were viewed as mostly insulated from the U.S. regional bank crisis. Emerging markets logged slightly positive returns through March but underperformed the S&P 500 thanks to still-elevated geopolitical stress, as U.S.-China tensions rose following the Chinese spy balloon affair.

Source: Koyfin

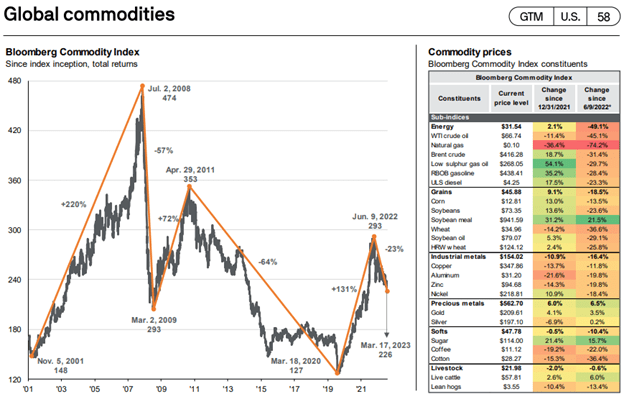

Commodities saw sharp declines in the first quarter thanks mostly to the notable weakness in oil prices, which hit fresh 52-week lows. Oil fell during the first quarter on rising global recession worries and subsequent reductions in demand expectations, while geopolitical risks didn’t rise enough to offset those demand concerns.

Source: JPM Guide to the Markets

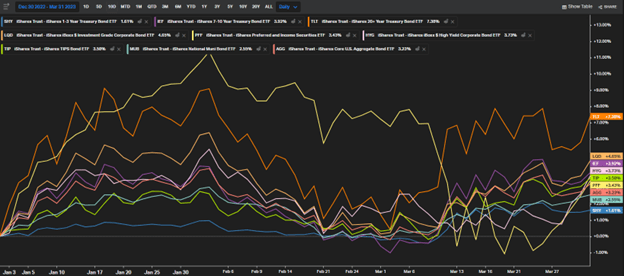

Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the first quarter of 2023, although bonds were volatile to start the year. The Fed signaling an imminent end to rate hikes combined with concerns that the regional banking crisis would raise the odds of a recession, fueled a broad bond market rally in the first quarter.

Source: Koyfin

Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the first quarter of 2023, although bonds were volatile to start the year. The Fed signaling an imminent end to rate hikes combined with concerns that the regional banking crisis would raise the odds of a recession, fueled a broad bond market rally in the first quarter.

Second Quarter Market Outlook

Markets begin the new quarter facing multiple sources of uncertainty including the path of inflation, future economic growth, the number of remaining Fed rate hikes, and whether the regional banking crisis is truly contained. Yet despite all this uncertainty, markets have proven resilient over the past six months since hitting their lows in October of 2022. So, while headwinds remain in place and markets will likely stay volatile, there remains a path for future positive returns.

Starting with the regional banking crisis, despite consistent comparisons in the financial media between what happened in March and the 2007-2008 financial crisis, there are important differences between the two periods and regulators have already demonstrated their commitment to ensuring we do not experience a repeat of those difficult days. As we begin the new quarter, there is reason for hope this crisis has been contained. But regardless of whether that’s true, regulators and government officials have proven they are ready to use current tools (or create new ones) to prevent a broader spread of the regional banking crisis, and that’s an important, and positive, difference from 2008.

Regarding economic growth, markets rallied on the hope of an economic soft landing earlier in the first quarter, and while the regional banking crisis complicates that optimistic outlook, it is still possible. To that point, employment, consumer spending and economic growth more broadly have remained impressively resilient, so while we should all expect some slowing in the economy this quarter, a recession is by no means guaranteed. If the economy achieves a soft landing that will be a material positive for risk assets.

Finally, after one of the most intense interest rate hike campaigns in history, the Fed has signaled that it is close to being done with rate increases, and that will remove a material headwind on the economy. As long as that expectation for a looming end to rate hikes does not change, it’ll increase the chances that the economy can achieve the desired soft landing.

To be sure, this remains a tumultuous time in the markets. Investors are facing the highest interest rates in decades, the worst geopolitical tensions in years, and a very uncertain economic outlook that deteriorated in the wake of recent bank failures. But while concerning, it’s important to realize that underlying U.S. economic fundamentals and U.S. corporate earnings proved incredibly resilient through the first quarter. And those two factors, steady economic growth and strong earnings, are the real long-term drivers of market performance, not the latest disconcerting geopolitical or financial headlines.

As such, we are prepared for continued volatility and are focused on managing both risks and return potential. We understand that a well-planned, long-term-focused, and diversified financial plan can withstand virtually any market surprise and related bout of volatility, including bank failures, multi-decade highs in inflation, high interest rates, geopolitical tensions, and rising recession risks.

We understand the risks facing both the markets and the economy, and we are committed to helping you effectively navigate this challenging investment environment. Successful investing is a marathon, not a sprint, and even intense volatility is unlikely to alter a diversified approach set up to meet your long-term investment goals.

Therefore, it’s critical for you to stay invested, remain patient, and stick to the plan, as we’ve worked with you to establish a unique, personal allocation target based on your financial position, risk tolerance, and investment timeline.

We remain vigilant towards risks to portfolios and the economy, and we thank you for your ongoing confidence and trust. Please rest assured that our entire team will remain dedicated to helping you successfully navigate this market environment.