Q2 Market Commentary

Continued improvement in the market and economy with policy change headwinds on the horizon

The S&P 500 rose to another record high during the second quarter as a substantial decline in U.S. COVID-19 cases combined with a near-total economic reopening across the country led a surge in economic growth that helped stocks rally to new highs over the past three months.

Meanwhile, the Federal Reserve reiterated its support for the economy and promised not to remove any accommodation in the near term. That continued “safety net” gave investors confidence in the future economic outlook and the sustainability of the economic recovery. Finally, first-quarter corporate earnings were very strong, as the vast majority of U.S. companies beat earnings estimates. These positive factors helped stocks rally throughout the month, as the S&P 500 hit a new record above 4,200 during the final days of April.

The rally paused in May, however, thanks to uncertainty regarding inflation, the labor market and when the Federal Reserve would begin to reduce, or taper, its quantitative easing (QE) program. A disappointing jobs number in early May implied the labor market might not be recovering as quickly as expected. That, combined with inflation metrics hitting multi-decade highs, elicited some concern the economic recovery might not be as strong as forecasted, and that a return of inflation might make the Federal Reserve begin to reduce accommodation earlier than previously expected. Federal Reserve officials reiterated their long-held position that any increase in inflation would be temporary and due to pandemic-related supply chain disruptions and not the return of 1970’s style inflation problems. Investors were comforted enough for stocks to rebound in mid-May and close the month with a small gain.

Stocks resumed the rally in early June, as more state economies returned to pre-pandemic normal (most notably California), measures of economic activity remained strong, and certain inflation statistics implied that inflation pressures were starting to ease, possibly validating the Fed’s belief that surging inflation is just temporary. The June Fed meeting provided a small surprise to markets, as it revealed that Federal Reserve officials began discussions about when to reduce the current quantitative easing program, while Federal Reserve forecasts showed interest rates could start to rise late in 2022, sooner than previously expected. Those two surprises caused some mild market volatility late in June, although ultimately investors remained confident that the Federal Reserve will not remove economic support too quickly and the S&P 500 hit another record high during the last few days of the quarter.

In sum, the strong gains of the second quarter and the first half of 2021 reflected continued government support for the economy combined with a material improvement in the pandemic in the U.S., and as we start the second half of 2021, we are happy to say the world looks a lot more like it did pre-pandemic than it did for most of 2020, and that sentiment is supportive of risk assets going forward.

2nd Quarter Markets Overview

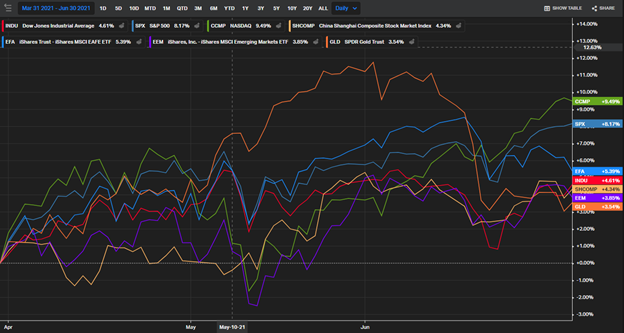

In a reversal from the first quarter, the Nasdaq outperformed both the S&P 500 and Dow Jones Industrial Average thanks to a June rally in technology shares, as investors began to consider that the intensity of the economic recovery had possibly peaked now that virtually all state economies had fully reopened.

By market capitalization, large-cap stocks outperformed small-cap stocks, which was a reversal from the previous two quarters. Small-cap stocks tend to outperform during periods of accelerating economic growth, like we saw in the fourth quarter of 2020 and the first quarter of 2021. But with investors considering that the intensity of the economic recovery may have peaked in the second quarter and that the Fed may reduce QE in the future, they rotated back into large caps as the outlook for future economic growth became slightly less certain.

From an investment-style standpoint, growth handily outperformed value thanks to the aforementioned tech sector rally, as again investors positioned for the possibility that the intensity of the economic recovery may wane in the coming months.

On a sector level, 10 of the 11 S&P 500 sectors realized positive returns in the second quarter with real estate and tech outperforming. The real estate sector was boosted by a decline in mortgage rates combined with consumers returning to malls and shopping centers, while a drop in Treasury bond yields helped fuel the rotation back to tech stocks.

Internationally, foreign markets saw positive returns in the second quarter thanks to further declines in COVID-19 cases, rising vaccination rates, and more widespread economic reopenings across the EU and UK. Emerging markets also rallied in the second quarter on hopes of a global economic recovery, although they slightly underperformed foreign developed markets as the Chinese government reduced support for its economy following a large increase in inflation indicators.

Commodities posted strong gains for the third quarter in a row and once again outperformed the S&P 500 over the past three months. Major commodity indices were led higher by another large rally in crude oil futures as demand rose for both oil and refined products following the U.S. and European economic reopenings. Gold, meanwhile, posted a small gain as investors rotated back to gold following a spike in inflation metrics, combined with an increase in volatility in Bitcoin, which sent money back into more traditional non-correlated, safe-haven assets.

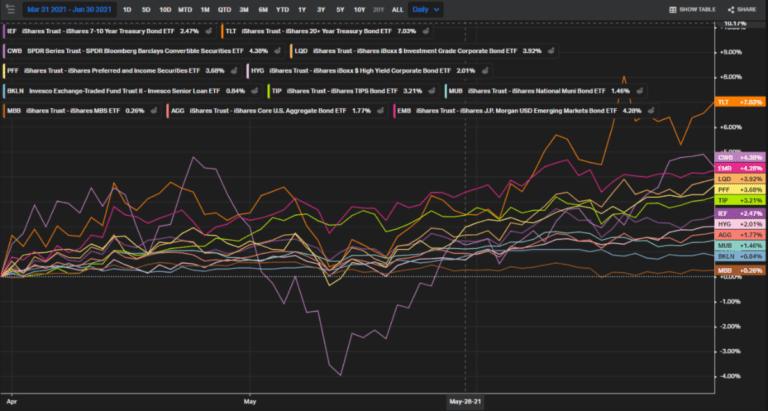

Switching to fixed income markets, second quarter total returns for most bond classes were positive, a reversal from the first quarter. Despite inflation indicators surging to multi-year highs in recent months, investors viewed those increases as temporary phenomena related to the global economic reopening and short-term supply chain issues. As such, investors took advantage of relatively higher bond yields in the second quarter.

In the corporate debt markets, investment grade bonds solidly outperformed lower-quality, higher-yielding bonds. That investment grade outperformance reflects confidence in the sustainability of the U.S. economic recovery but also acknowledges that the pace of economic growth may moderate in the coming months.

3rd Quarter Market Outlook

Markets reflected a legitimate improvement in the macroeconomic outlook during the second quarter as substantial progress against the pandemic helped underwrite the gains in stocks over the past three months. But that strong performance should not be taken as a signal that risks no longer remain, and in fact the next three months will bring important clarity on several unknowns including inflation, future Federal Reserve policy, and the pandemic.

Regarding inflation, some metrics in June implied that the spike in inflation during the second quarter is starting to reverse, but that debate is far from settled. To that point, no one knows what the trillions in pandemic stimulus combined with 0% interest rates and the Fed’s ongoing QE program will do to inflation over the longer term. If this sudden surge in inflation is indeed just temporary, we should see more conclusive evidence of that during the third quarter.

The Federal Reserve, meanwhile, has started the process of communicating how it will begin to reduce support for the economy via “tapering” or reducing, its quantitative easing program. The last time the Fed had to deliver that message, they triggered the “Taper Tantrum” of 2013, which saw stock and bond market volatility rise significantly; and it remains to be seen how expected removal of accommodation and an eventual increase in interest rates will impact markets.

In sum, while there has been material progress made in the United States against the pandemic, and life as we know it has thankfully returned mostly to normal, now is not a time to become complacent as numerous economic and pandemic-related risks remain. As such, while the macroeconomic outlook is still decidedly positive, we should all remain prepared for bouts of market volatility with expected policy change.

Yet while risks remain to the markets and the economy, as they always do, it is important to remember that a well-executed and diversified, long-term-focused financial plan can overcome bouts of even intense volatility, like we have seen over the last 18 months.

At Insight Wealth Strategies, we understand the risks facing both the markets and the economy, and we are committed to helping you effectively navigate this still-challenging investment environment. Successful investing is a marathon, not a sprint, and even temporary bouts of volatility like we experienced during the height of the pandemic are unlikely to alter a strategic diversified approach set up to meet your long-term investment goals.

Therefore, it’s critical for you to stay methodical, remain patient, and stick to the plan, as we’ve worked with you to establish a unique, personal allocation target based on your financial position, risk tolerance, and investment timeline.

The economic and medical progress achieved so far in 2021 notwithstanding, we remain vigilant towards risks to portfolios and the economy, and we thank you for your ongoing confidence and trust. Please rest assured that our entire team will remain dedicated to helping you successfully navigate this market environment.

Please do not hesitate to contact us with any questions, comments, or to schedule a portfolio review.

Want to discuss the market in more detail?

This commentary is provided for information purposes only and does not pertain to any security product or service and is not an offer or solicitation of an offer to buy or sell any product or service. Unless otherwise stated, all information and opinion contained in this publication were produced by Insight Wealth Strategies, LLC. (“IWS”) and other sources believed by IWS to be accurate and reliable. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. The information provided does not constitute investment advice, and it should not be relied on as such. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon.

Insight Wealth Strategies, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Insight Wealth Strategies, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Insight Wealth Strategies, LLC unless a client service agreement is in place.