Retirement Planning for Marathon Employees

Secure your retirement with Insight Wealth Strategies. Our experienced advisors specialize in helping Marathon Oil employees navigate the complexities of retirement planning, from maximizing pension benefits to crafting personalized investment strategies that align with your goals. Take the next step toward financial confidence today.

Understanding Marathon's Retirement Plan

Marathon Oil’s retirement plan is designed as a comprehensive resource to help employees build a secure retirement. This plan operates as a cash balance retirement plan, which grows over time with annual Pay Credits and monthly Interest Credits. These elements ensure that your retirement savings accumulate consistently throughout your career with Marathon Oil, providing the money you need when you retire.

Eligibility and Vesting Periods

Marathon employees become eligible for the retirement plan on their first day of employment, making it easier to start accruing benefits without delay. Most employees achieve full vesting after three years of working, ensuring that your retirement savings are protected as long as you meet the vesting requirements.

Planning for Early Retirement

Marathon’s plan offers flexibility for early retirees starting at age 50, provided they meet the vesting requirements. The early retirement benefits can be received at reduced rates compared to full retirement at age 65. This allows those affected by layoffs to consider early retirement options while securing their financial future.

Ready to take control of your Marathon retirement planning?

Navigating Layoffs: Protecting Your Retirement

With anticipated company restructuring and potential layoffs, it’s important to understand your retirement options. For vested employees, your benefits remain secure even if your employment ends. Here are some key options:

- Lump Sum Payment: Receive your accumulated benefits as a one-time payment.

- Monthly Pension Payments: Opt for consistent monthly payments for ongoing income post-retirement.

In cases of involuntary termination due to a company-wide change in control within 24 months, employees become fully vested even if they haven’t met the three-year service threshold.

Managing Pensions After Termination

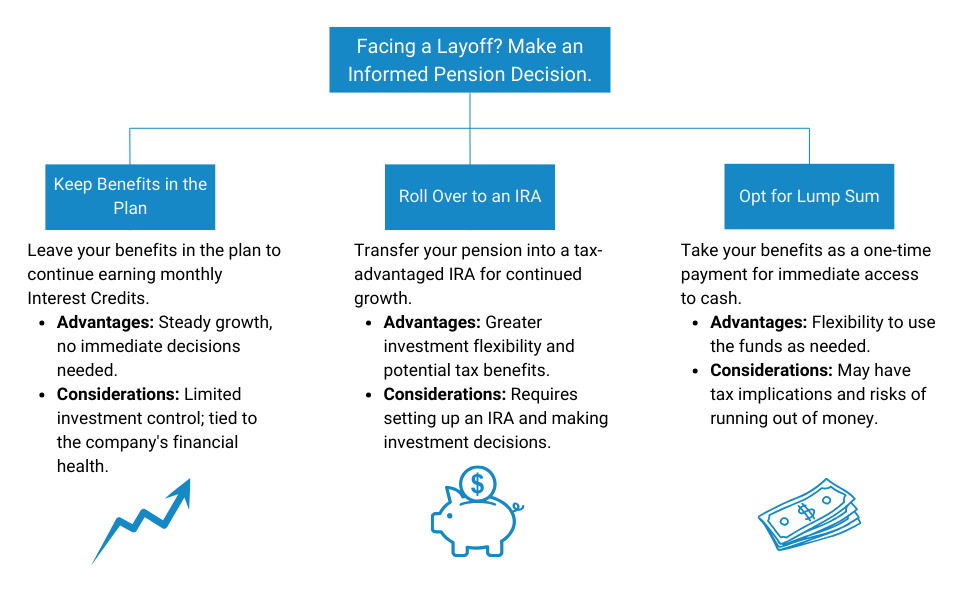

If you experience a layoff or voluntary termination, it’s crucial to make informed decisions about your pension.

Making the right choice for your pension can significantly impact your long-term financial health. Whether you leave your benefits in the plan, roll them into an IRA, or take a lump sum, Insight Wealth Strategies helps align these decisions with your money goals while minimizing potential tax liabilities.

How Insight Wealth Strategies Can Help You Plan for Retirement from Marathon

At Insight Wealth Strategies, we understand the nuances of Marathon’s retirement packages and how to best utilize these benefits for a secure life after working. Our approach is tailored to help you make the most of your company-provided plan and guide you through key decisions such as:

- Evaluating Your Retirement Options: We provide personalized retirement planning advice to help you decide between taking a lump sum or choosing monthly pension payments.

- Optimizing Your Pension Benefits: Our team assists you in strategizing how to maximize your retirement savings, ensuring you’re making informed choices that align with your financial goals.

- Planning for Early Retirement: If early retirement is an option you’re considering due to layoffs or other circumstances, we help assess the financial implications and plan accordingly.

Insight Wealth Strategies, LLC is not affiliated with Marathon Oil.

Frequently Asked Questions About Marathon Oil Retirement & Benefits

- If you are laid off, your Marathon retirement benefits are still protected as long as you are vested. You can choose to leave your benefits in the plan, roll them over into an IRA, or take a lump sum payment. Each option has different financial and tax implications.

Yes, Marathon’s retirement plan allows early retirement benefits starting at age 50, provided you meet the vesting requirements. However, benefits may be reduced based on how early you choose to retire. A financial advisor can help you assess if early retirement is the right choice for you.

If you are laid off, your pension remains secure if you are vested. You may still have the option to leave it in the plan, roll it over, or take a lump sum. Understanding these options is critical for protecting your retirement savings.

- A financial advisor who understands Marathon Oil’s retirement plans can help you navigate complex options, optimize your pension benefits, and create a personalized retirement strategy. This ensures you’re making the best decisions for your financial future.

Employees can maximize their 401(k) by contributing the IRS annual maximum and leveraging Marathon Oil’s employer contributions. This reduces taxable income and grows retirement savings faster. Insight Wealth Strategies can provide financial planning guidance to help you optimize contributions and ensure they align with your long-term financial goals.

Social Security supplements your Marathon Oil retirement plan by providing additional monthly income. Our wealth management experts integrate Social Security with your 401(k), pension, and investments for a comprehensive retirement strategy.

Lump sum and monthly pensions are slightly different. Lump sum payments offer flexibility to invest or manage savings, while monthly pensions provide steady, guaranteed income. Insight Wealth Strategies helps you weigh tax implications, investment options, and financial stability to choose the best option for your retirement plan.