San Ramon Financial Planning

Financial Planning for San Ramon Families

Naturally, you’re looking for solid strategies to help you meet your financial goals. Whether you’re exploring the stock market, saving to send a child to college, preparing for tax season, or simply streamlining your monthly budget, rely on the top San Ramon qualified financial advisors from Insight Wealth Strategies to get the job done right.

Financial Planning for Your Unique Needs

Searching for a financial advisor? San Ramon fiduciaries from Insight Wealth are ready to put their skills to work for you, from asset management to estate planning.

Our services are wide-ranging and catered to your personal needs and individual situation. When you schedule a complimentary meeting with our financial professionals, we’ll lay the groundwork to help you achieve your financial vision. The possibilities are endless:

- Start saving for your dream vacation home

- Manage a recent inheritance

- Make preparations to care for a family member in need

- Seek guidance on employer benefit plans and retirement accounts

- Maximize your upcoming tax return

- Establish a college fund for children or grandchildren

- Review your existing financial plan and find opportunities for improvement

Financial management shouldn’t require you to fit into a restrictive box.

We take the time to get to know you on a personal level so we can structure our financial plan around your desires. Our fiduciaries follow a five-step process:

- Engage – Your advisor will assess your needs through meetings (in person, over the phone, or online).

- Collect – Our team will conduct research and gather data about your financial situation.

- Analyze – We’ll crunch the numbers, perform comparative analysis, and put our state-of-the-art technologies to use combing through all the relevant information.

- Design – Your advisor will develop a totally personalized, sophisticated, actionable financial plan for you and your loved ones.

- Implement – Your Insight Wealth fiduciary will assist you in putting your plan into action, and keep a close eye on all the details as things progress or your situation changes.

Find Financial Advisors in San Ramon, CA

Stop worrying about your financial future, and start enjoying more of your day-to-day.

Your Insight Wealth advisor will stick by you through all of life’s unexpected twists and turns, ensuring that your financial model remains resilient and viable.

You have everything to gain from working with a certified financial advisor. San Ramon, CA is a fantastic place to build a life—let us help you make the most of it.

.

Our Service Offering

- Financial planning – Cover all your bases, and feel completely confident about your financial situation

- Retirement planning – Set yourself up to enjoy retirement to the fullest

- Investment management – Ensure your portfolio stays resilient, and responsive in an ever-changing financial landscape

Whether you’re looking for San Ramon investment management, San Ramon retirement planning, or a financial planner – we’re proud to offer robust financial services to the entire San Ramon area. San Ramon wealth management from Insight Wealth transforms our clients’ finances for the better.

Financial Planning FAQs

High-quality financial planning services are absolutely worth it, particularly when you work with a fee-only fiduciary firm. Establish a comprehensive budget, diversify and strengthen your investment portfolio, and save more effectively (for retirement, for your first home, for your child’s college tuition, or for that dream vacation fund). It all becomes so much simpler with help from a qualified financial advisor. Contact us today to see how we can help you transform your finances for the better.

“Financial planning” is an umbrella term that encompasses a variety of financial services. At Insight, we cater our planning services to the unique needs and desires of our clients—you let us know what your financial goals are, and we develop an actionable plan to meet them. That could mean opening investment or retirement accounts, altering your investment strategy, creating a savings plan for major expenses, evaluating a real estate purchase, and so much more.

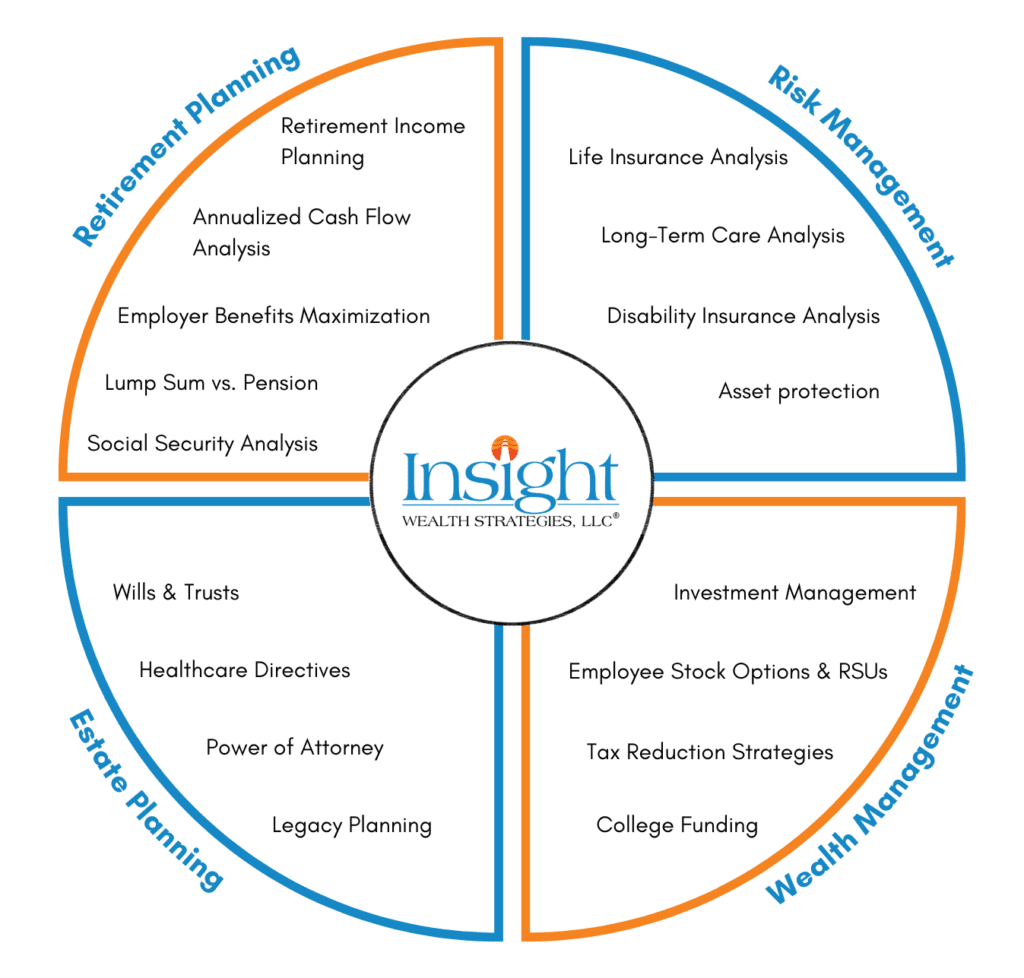

Financial advisors offer a range of services including financial planning, investment management, retirement planning, tax strategies, estate planning, and risk management. They tailor these services to meet the unique needs of each client. Financial advice from a qualified financial advisor can help you stay ahead of your money management and reach your financial goals.

A personalized financial plan offers several benefits. Your plan is uniquely tailored to your individual financial goals, whether that includes retirement savings, home purchase, or funding education. The plan and a qualified financial professional considers your risk tolerance, aligning investments with your comfort level and time horizon. It takes a comprehensive approach, addressing budgeting, debt management, tax strategies, and estate planning.