Year-End Tax Planning: Top Strategies for 2025

Year-End Tax Planning: Top Strategies for 2025 As the year comes to a close, it’s

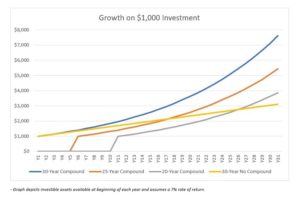

Increase contributions to retirement plans. One of the best ways to reduce your taxable income is to contribute the maximum amount possible to a retirement plan. Contributing to tax-deferred retirement accounts also allow contributions to grow tax-deferred over time. If your employer sponsors a retirement plan such as a 401(k) plan, they may possibly offer a match on contributions as well. In 2021, individuals can contribute up to $19,500 to a 401(k) plan, and individuals age 50 and older can contribute an additional $6,500 for a total of $26,000. If your employer doesn’t sponsor a retirement plan, contributing to an IRA is another good option to save money for retirement and reduce your taxable income. In 2021, individuals with earned income can contribute a maximum of $6,000 to an IRA and an additional $1,000 if you are age 50 or older.

Contributing to a Health Savings Account (HSA) can also lower taxable income. Contributions to HSAs are not subject to federal income taxes. Earnings to an HSA from interest and investments are tax-free as well. Finally, distributions from an HSA to pay for qualified medical expenses are tax-free.

Deferring income to the future can help you reduce taxes this year. Individuals who are self-employed may have a greater opportunity to take advantage of this strategy. Income is taxed in the year it is received – you will still have to pay the taxes on the income at some point, but this strategy might be useful to individuals who anticipate having a lower income next year.

Tax deductions are a great way to lower your tax bill, such as donating to charity. There is an extra potential benefit for those who choose to donate appreciated stock instead of cash as well.

If you happen to have investments such as stocks, mutual funds or ETFs that experience losses, you can use those losses to offset taxable gains for the year. The offsets of gains are allowed on a dollar-for-dollar basis. If your losses exceed your gains for the year, you also have to ability to use up to $3,000 in losses to offset other income. Additional losses can be carried over year after year.

For people with children under age 18, and especially under age 14 consider contributing to a qualified tuition plan (Section 529 plan) Unlike a Coverdell Educated Savings Account (CESA) there are no AGI limits on contributions to 529 plans. However, distributions of earnings from a 529 plan are tax-free only if used to pay for higher education expenses (college and above). 529 beneficiaries can be changed if funds remain in the plan and the original beneficiary no longer has any need.

Make annual exclusion gifts before year-end to save gift tax and estate tax. You can gift $15,000 per person ($30,000 as husband and wife) in 2021 to an unlimited number of individuals free of gift tax. However, you cannot carry over unused exclusions from one year to the next. The transfers also may save family income taxes where income-earning property is given to family members in lower income tax brackets who are not subject to the kiddie tax.

More Content You Might Like

Year-End Tax Planning: Top Strategies for 2025 As the year comes to a close, it’s

Why it’s Hard to Stay Disciplined in Volatile Markets A long-term retirement investment strategy, resulting

Why Having an Investment Plan is Important What is Investment Planning? Investment planning is a

Utilizing the Power of Compound Interest For investors, there is unfortunately no magic wand or

Understanding the Required Minimum Distribution In an effort to encourage workers to save for retirement,

Understanding Stock Market Corrections: What Every Investor Should Know What is a Stock Market Correction?

Make an appointment today with one of our financial advisors in the California, Bay Area or Houston, TX and see how Insight can help you.