2022 Year in Review and Financial Updates for 2023

When 2021 wrapped up, the U.S. economy had grown at its fastest rate since Ronald Reagan was President (1). Entering 2022, we were expecting higher volatility to be driven mainly by the Federal Reserve. Unfortunately, as we progressed through 2022, the story we expected had been completely rewritten again.

In March, Russia invaded Ukraine, which stroked geopolitical tensions. We also saw significantly higher inflation than expected, which changed the tenor of the Federal Reserve and the magnitude of interest rates. Not only did energy and food prices drive up inflation, we also saw the highest price increases in decades across other industries such as travel, hospitality, medical services, and housing. Even inexpensive purchases like candy were not immune to this ghastly inflation, as a recent report by the U.S. Bureau of Labor Statistics showed that candy and chewing gum prices were 72% higher in 2022 than in 1997 (2).

There were some notable strengths in 2022, particularly in the labor market, which reflected not only a low unemployment rate and monthly job gains, but also higher wage gains (3).

Many leading economists believe that inflation has peaked and expect it to recede into 2023. A recovering supply chain should also help to ease inflation, as studies show improvement in order backlogs and supplier deliveries (4).

Rent prices, which are typically a significant contributor to inflation, are showing signs of cooling down. Reports show that while rents peaked in July, the Realtors.com October Rental Report indicated that rent prices fell for the third straight month.

While there are signs that inflation is slowing, financial experts are expecting the Federal Reserve to increase rates further by 0.5% at the next meeting on December 14 (5). While the Fed’s monetary policy in 2023 remains unknown, the high inflation of 2022 has brought increased contribution limits and other financial planning strategies for 2023, which could prove beneficial for many. Let’s review the upcoming changes below.

2023 Financial Updates

Starting in 2023, individuals can increase their 401(k) contribution by $2,000 to $22,500. For those over the age of 50, they can contribute an additional $7,500, an increase of $1,000 over 2022 to $30,000. For those whose plan allows the ability to make supplemental after-tax contributions, the IRS limit for Defined Contribution plans like a 401(k), 403(b) and the government’s Thrift Savings Plan is $66,000 for those under 50, an increase of $5,000. For those over age 50, the IRS limit for Defined Contribution plans is $73,500, an increase of $6,000.

Contributions for Individual Retirement Accounts (IRAs) increased to $6,500 in 2023 vs $6,000 this year. For those 50 or older and eligible, they can contribute $7,500 to their IRA, unchanged from 2022. The amounts mentioned apply to both Traditional IRAs and Roth IRAs.

Health Savings Accounts or HSAs have also increased limits for 2023. HSAs have increased in popularity, allowing individuals and families to save for healthcare expenses on a pre-tax basis, lowering taxable income and investing contributions which can be used for long-term growth. The dollars can grow tax-free if they are used for qualified medical expenses. Starting in 2023, the annual contribution limit will be $3,850 for an individual and $7,750 per family per year. For those over 50 years old, they can contribute an additional $1,000 per year.

Tax Planning

Thanks to 2022’s inflation rates, the Standard Deduction when filing your tax return has increased as well. For single taxpayers, the Standard Deduction will increase by nearly $1,000 to $13,850 and for married couples filing jointly, the increase is nearly $2,000 rising to $27,700. The higher Standard Deduction will help lower taxable income, keeping more money in your pockets.

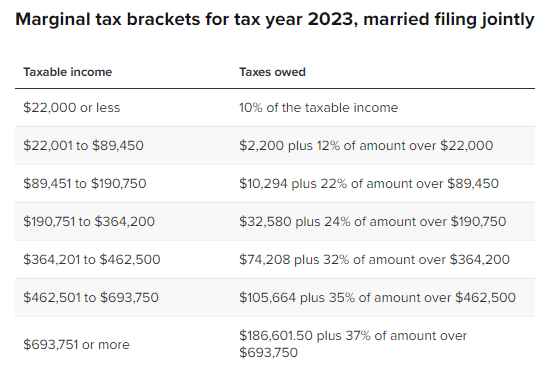

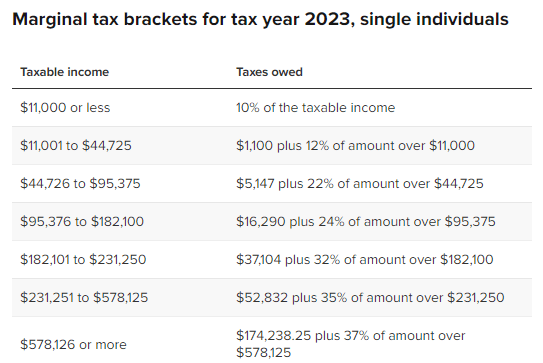

Another tax planning area that is adjusting for 2023 is the marginal tax bracket ranges. The IRS increased the income threshold for each tax bracket starting in tax year 2023. This should help households pay less taxes when they file tax returns in early 2024.

For example, a single tax filer in 2023 with taxable income of $95,000 will have a top rate of 22%, down from 24% in 2022. That results in tax savings of nearly $430 assuming no other changes.

Below are the 2023 Tax Brackets (6).

While 2022 was a challenging year for markets, personalized financial planning can help ensure you are properly positioned based on your unique situation no matter the state of financial markets.

We encourage readers to consider personal financial planning and to take advantage of retirement and tax planning opportunities. The end of the year can be a good time to meet with your advisor to set goals and expectations for the coming year. We at Insight Wealth Strategies encourage our clients to reach out with any questions at any time.

Written by,

Alex Austin, CFP®

Alex is a comprehensive, fee-only financial planner. Alex made a career move into personal financial planning and investment management after 10 years in investment banking and corporate finance to find more meaning in his work and better match his personality and interests to his career. It’s worked out better than he could have imagined.

Want to read more articles by Alex?

Insight Wealth Strategies, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Insight Wealth Strategies, LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Insight Wealth Strategies, LLC unless a client service agreement is in place.

Insight Wealth Strategies, LLC (IWS) and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Sources:

- https://www.abc12.com/news/national/the-u-s-economy-grew-at-the-fastest-rate-in-2021-since-the-reagan-administration/article_2b81b1e1-022a-5346-ade5-8a0c55317f06.html#:~:text=US%20gross%20domestic%20product%20expanded,York%20on%20December%2013%2C%202021.&text=The%20U.S.%20economic%20recovery%20from,pandemic%20continued%20strong%20last%20year.

- https://www.in2013dollars.com/Candy-and-chewing-gum/price-inflation

- https://www.whitehouse.gov/cea/written-materials/2022/12/02/the-employment-situation-in-november-2/

- https://www.cnbc.com/2022/11/30/fed-chair-jerome-powell-says-smaller-rate-hikes-could-come-in-december.html

- https://taxfoundation.org/2023-tax-brackets/