Insight Wealth Strategies’ investment process helps determine the most appropriate asset allocation for our clients’ unique needs. A driving factor of our investment philosophy is ranking assets based on a risk-adjusted return. Our in-house portfolio management team uses quantitative and fundamental analysis to determine which assets make up our portfolios. Our investment management team continuously monitors and reviews market trends, economic conditions and performance and update our portfolios as needed.

Schedule a complimentary meeting or phone call below with our Investment Team in San Ramon, CA or Houston, TX

Effective financial planning is only possible with the help of precise modeling. We use industry-leading software that allows us to create an individualized financial condition model where:

Investment Resources For You:

Then partnering with Insight Wealth Strategies may be your ideal solution.

Investment management, also referred to as asset management or portfolio management, is the professional management of financial assets to help a client meet his or her investment and financial goals and objectives. This includes the buying and selling of assets, implementing short-term and long-term investment strategies and portfolio management.

Investment management is an important aspect of wealth management, a service in which a firm works with a client to construct a personalized strategy that can include investment advice, retirement planning, a review of insurance needs and other services to serve the client’s unique situation.

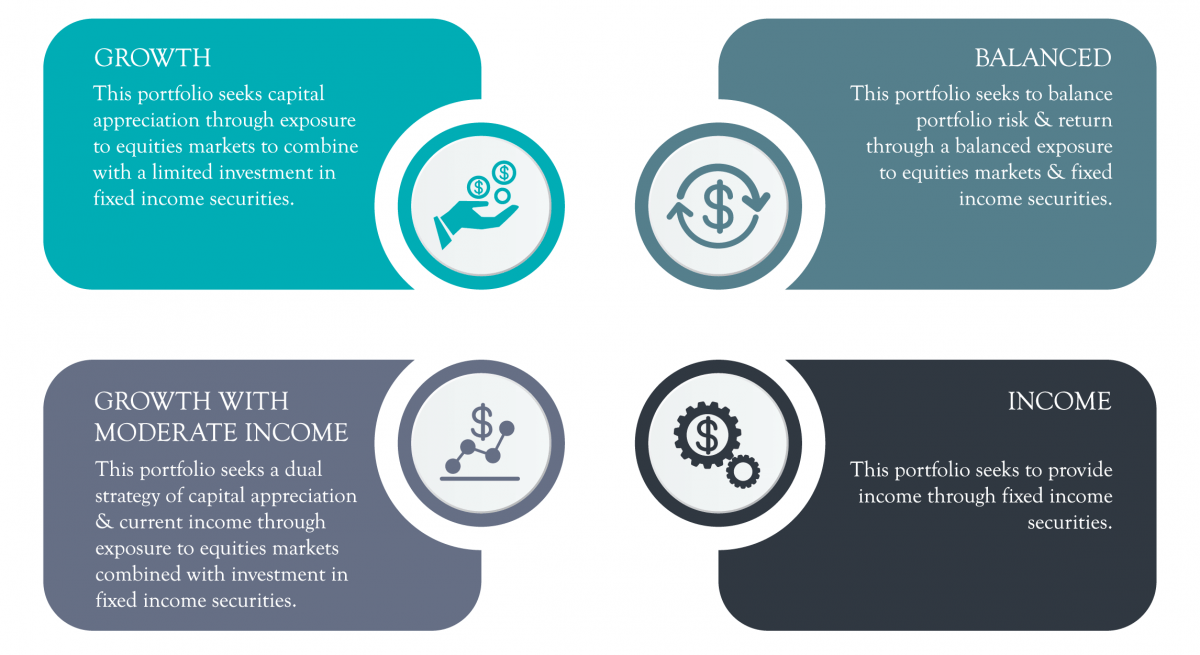

An investment management firm can offer services that include asset selection and allocation, portfolio strategies and implementation of those strategies. In working with their clients and determining their clients’ risk tolerance, risk capacity and time horizon, investment management firms are able to recommend appropriate portfolios and investment strategies. Investment managers help their clients make investment decisions to meet their short-term and long-term financial goals.

Investment management firms generally charge a fee for the assets under the firm’s management. This fee is usually a percentage of the total value of the portfolio under management. Many firms charge a management fee of around 1 percent, and offer a sliding fee scale depending on the amount of assets held.

Our financial planners and in-house investment management team will provide clients with professional asset management that puts our clients’ needs first and ensures their portfolio remains in alignment with their financial goals, risk tolerance and timeframe. Our models have the potential to provide asset growth while protecting against downside risk.

To learn more about Insight Wealth Strategies, call us at (800) 318-7848, email us at [email protected] or Request More Information.

Chad began his career with Sagemark Consulting in 2005 and then became a Select member of Sagemark’s Private Wealth Services which operated as a national resource for financial planners focusing on Advanced Strategies in the High Net Worth marketplace. Chad then began his partnership with Insight Wealth Strategies in 2013 focused on retirement planning primarily with Oil and Gas employees and executives. His primary areas of expertise are retirement, estate, and investment strategies as he serves as Investment Strategist for the financial planning team.

Chad is an involved emerging leader with the Global Interdependence Center which is a monetary policy and global trade think tank for the Philadelphia Federal Reserve Bank. He is also a supporting Member of the World Affairs Council.

Cole began his career with Sagemark Consulting where he assisted with portfolio management for a team of advisors. He joined the Houston Insight Wealth Strategies team in 2018, where his responsibilities consist of researching, constructing, and managing portfolios for clients and advisors. Cole earned his BBA in Finance from Lamar University. Following his undergraduate degree, he earned his Master’s in Investment Management and Financial Analysis from Creighton University. Lastly, Cole is a CFA® charter holder.

Michael is a comprehensive, fee-only financial planner who began his financial services career with Insight Wealth Strategies in 2013. His primary areas of expertise cover retirement planning (e.g. cash flow analysis, developing retirement income strategies, stock option planning, corporate benefit analysis, etc.), investment planning, and high-level income tax reduction strategies for individuals and small business owners.

Michael’s approach to financial planning is to first understand the client’s unique situation and goals and begin identifying any gaps that may exist within the current plan the client may have in place. He believes that providing individuals with observations and taking the time to educate a client is just as important as the objective recommendations that he presents. Michael provides a great deal of personal attention to his clients and continues to monitor and adjust their financial plan as they progress through major life events and milestones.

Michael has previously passed his Series 7, 66, and Life and Health Insurance Licenses. In addition, Michael completed the process of becoming a CERTIFIED FINANCIAL PLANNER™ professional.

He currently lives in Danville with his wife Lauren. In their free time they can be found outside training for triathlons, watching bay area sports teams or traveling around the United States attending Zac Brown Band concerts.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements